4 Keys to a Successful Employee Financial Wellness Program in 2019

Anyone who’s looking into financial wellness has probably seen this stat: financial stress among employees cost U.S. businesses over $250 billion a year.

But it's a sad fact that not all financial wellness programs actually live up to the expectations, and more importantly, the real-life needs of the average employee.

According to the 2018 Bank of America Merrill Lynch Workplace Benefits Report employers tend to focus on quick fixes like budgeting and managing expenses, while employees prioritize their bigger, long-term goals for financial security. The disconnect is real - and damaging.

So what, then, makes a good financial wellness program? Here’s our expert take on what’s required:

1. A Financial Wellness Program That’s Personalized to Employees

People’s financial situations are as varied as their life experiences.

While one employee might be trying to set a retirement date, another might be facing the very first of their student loan payments. And then there’s the financial surprises (almost always unpleasant): unexpected medical bills, higher taxes, sick or aging parents, or others.

Given how dramatically different employees’ financial situations can be, it goes without saying that financial wellness programs should recognize these differences.

More specifically, your financial wellness program should take into account information about your employees like their age, marital status, income, and debt burdens, and be able to come up with personalized solutions designed to meet their specific needs.

Because, when financially stressful situations arise, employees want to know their next step. Which leads us to...

2. Employee Financial Wellness That Goes Beyond Education

Most financial wellness programs on the market today focus almost entirely on educating employees. And while financial literacy is absolutely necessary, by itself, it’s simply not enough.

To be successful, a financial wellness program has to inspire employees to take action.

You can provide all the financial education in the world, but if employees don’t take action and apply that education to their lives, neither your company nor your employees will see any benefit.

So, how do you inspire action from your employees? Simple, really. You have to make it easy.

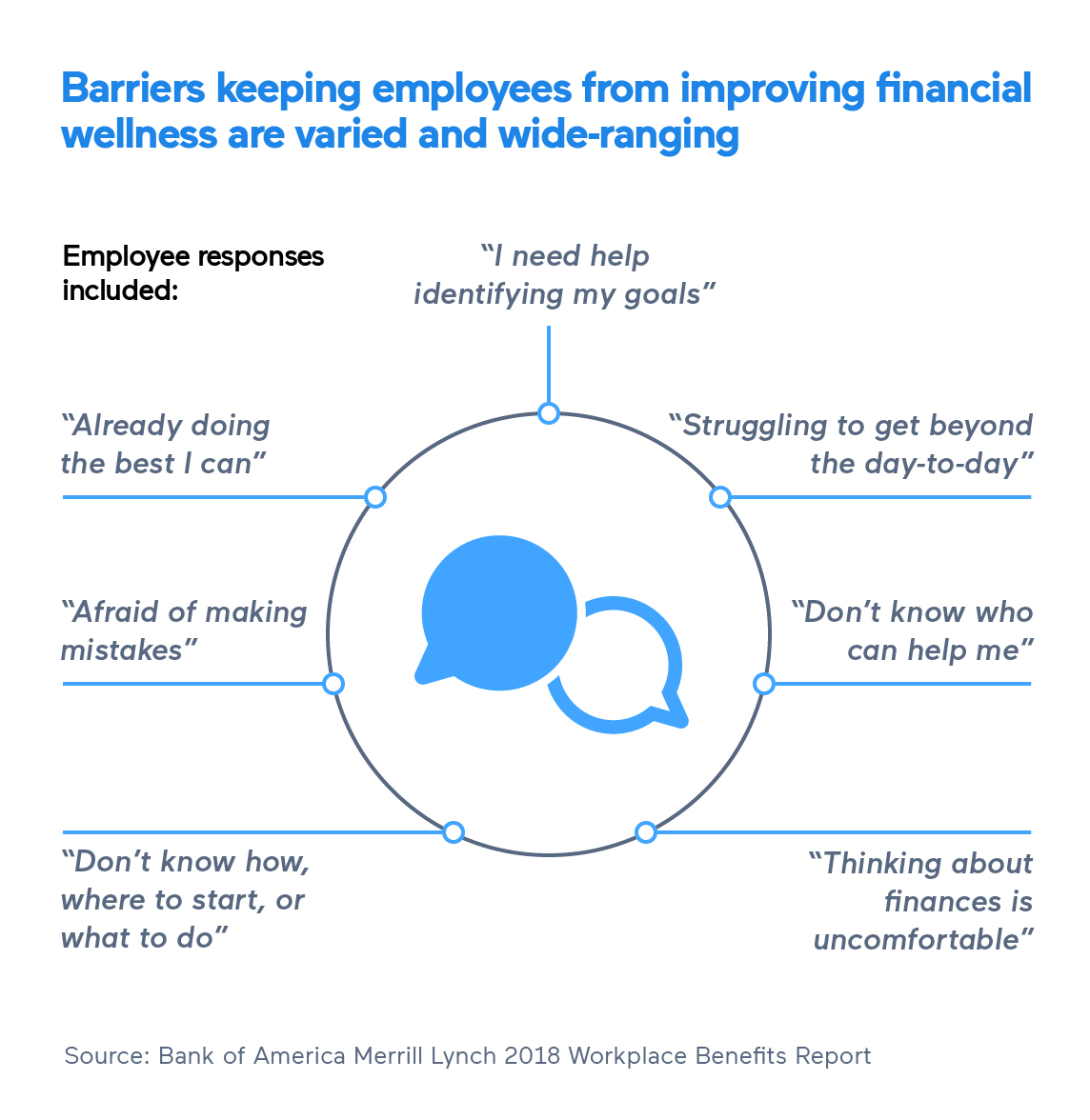

The reality is, many employees - especially those who aren’t financially-savvy - might get overwhelmed and not do anything at all.

When just thinking about money is a barrier, complex money-management speeches probably aren’t the answer. Instead, the solution is to simply make tackling personal finances easier to do.

So how, exactly, do you do this?

Well, there are a few different approaches you can take. You can provide tools for your employees, or help them select different financial service providers to help them out.

At ForUsAll, we like to leverage technology. Our financial wellness and advisory platform plugs right into your payroll system, analyzes each employee’s financial needs, and then makes it as easy as clicking a single button within their email to enroll in a financial program.

Beyond a personalized and easy-to-use solution, there are a few financial challenges any good program needs to focus on...

3. Your Financial Wellness Program Helps Employees with Student Debt

A 2015 study from the Institute for College Access and Success found that 68% of graduates from public and non-profit colleges had student loan debt. A degree from a public school generated an average loan balance of $25,550. Private colleges: $39,950.

With numbers like that, odds are you might have student debt of your own, so let’s not dwell on how dire the situation is. Let’s talk about the solution. If you’re an employer of educated professionals under 40, you should make student debt a priority within your financial wellness program.

There are actually a lot of options for people struggling with student debt, including:

- Financial Advising - An expert perspective can help employees plan and prioritize debt repayment.

- Loan Refinancing - Combining loans for lower interest rates can be enormously effective.

- Budgeting & Payment plans - Getting organized is sometimes all it takes.

- Employer Student Debt Relief Options - Some businesses offer student loan repayment benefits, like allowing 401(k) company contributions for employees who are paying off educational debt.

But debt is mildly terrifying, and employees often need help navigating those various solutions - that’s where your financial wellness program comes in. With the right guidance from an experienced advisor, employees can implement the best option for their situation.

Remember, employees want practical guidance on long-term financial goals. You can make your program so much more successful by supporting them in these efforts.

The other important long-term goal? You guessed it. Retirement.

4. A Financial Wellness Program That Sets Employees Up for Retirement

Not saving enough for retirement is the number one financial concern faced by Americans today. Building a nest egg is harder than ever, and people are feeling the strain.

As one of the top long-term goals of employees, a best-in-class retirement plan might be the most important component of an employee financial wellness program.

Here’s a snapshot of a best-in-class retirement plan:

- Low-cost: Planning for retirement should be affordable for everyone. While fees seem pretty low, a fee of 2% can end up eating half of the earnings on your savings. We like to see asset-based fees below 0.75%.

- Easy To Use: Mobile-friendly plan management, automatic plan features, and personal notifications mean better employee retirement plan participation.

- Friendly Support When They Need It: Getting help with retirement or any other financial matter is as easy as picking up the phone. Best-in-class retirement plans offer one-on-one consultations with licensed advisors.

That “best-in-class” distinction might sound a little excessive, but it’s worth paying attention to. Just as a poor financial wellness program can prove less than ideal, retirement benefits that don’t meet those standards may fall short.

Conclusion

And there you have it - 4 keys to a successful employee financial wellness program in 2019.

Implementing a strong financial wellness program - one that’s personalized, inspires action from your employees, and addresses major financial issues like student loans and retirement - can go a long way towards reducing your workforce’s stress, increasing their engagement, and ultimately helping your business be more successful.

Start by surveying your employees to understand which financial issues they need help with the most. Once you’ve taken this first step, you’ll have the information you need to create a financial wellness program that’ll engage your employees, alleviate their financial stress, and ultimately help your business be more expected.