Navigating top-heavy 401(k) tests: Everything you need to know in 2024

As a small business owner or HR manager, understanding the 401(k) top-heavy test is crucial for ensuring your retirement plan remains compliant and avoiding unnecessary penalties and fines.

In this blog post, we'll discuss:

Penalties for failing the top-heavy 401(k) test

Strategies to avoid being top-heavy

How to automatically pass the top-heavy test

What Is a top-heavy 401(k) plan?

A top-heavy 401(k) plan is one in which more than 60% of the plan's assets are owned by key employees. This top-heavy ratio is tested every year based on the account balances on the last day of the prior plan year, which is known as the determination date. The IRS conducts top-heavy testing to ensure that these plans do not disproportionately benefit high-ranking employees at the expense of other employees.

Who is considered a "key employee" in 2024?

IIn 2023, a key employee is defined by the IRS as an employee who meets one of the following criteria:

- An officer making over $220,000 (up from $215,000 for 2023); or

- A 5% owner of the business; or

- A 1% owner of the business making over $150,000.

Family-owned businesses often have more difficulty with 401(k) top-heavy tests due to the family aggregation rules. Essentially, any spouse, child, grandparent, or parent of a 5% owner is treated as a key employee. Importantly, family members are treated as a single group when calculating ownership – even if no single family member owns 5%, they are all key employees if they own 5% in aggregate.

A non-key employee is everyone else.

If a plan fails the top-heavy test, it must meet certain minimum contribution and vesting requirements to avoid tax penalties.

Top-heavy testing calculation and 401(k) top-heavy test rules

The top-heavy test is calculated by comparing the total value of key employee balances to the total value of all employees' account balances. If the ratio exceeds 60%, the plan is considered top-heavy and must meet additional requirements to maintain its tax-qualified status.

Top-heavy 401(k) penalties and top-heavy minimum contributions

If a plan fails the top-heavy test, it must meet certain minimum contribution and vesting requirements to avoid tax penalties. Employers may have to contribute up to 3% of each non-key employee's eligible pay to their account or match key employee contributions up to 5%, whichever is less. Unlike the ADP and ACP tests, you cannot simply return funds to key employees – you have to make contributions.

If you were not planning on contributing to the 401(k), having an unexpected 3% increase in payroll expenses can be challenging for many small businesses.

Which types of plans are most at risk of failing the top-heavy test?

Smaller businesses and those with a significant portion of assets concentrated among key employees are more susceptible to failing the top-heavy test. Family-owned businesses, start-ups with substantial equity given to founders and early employees, and companies with a few highly paid executives are particularly at risk.

Examples of penalties for failing the top-heavy test

The financial penalties for failing the top-heavy test can be significant for both employers and employees. Let's examine a few numerical examples to better understand the potential costs involved:

Example 1: $45k of unexpected contributions and penalties

Imagine a small business with 10 employees with a total of $1,000,000 in its 401(k) plan. The key employees hold $700,000 (70%) of the plan assets, making the plan top-heavy. The company did not make the required minimum contributions for non-key employees, which amounts to $30,000 (3% of their combined salaries). In this case, the company would face a penalty of $15,000 (50% of the missed contributions) on top of the minimum contribution of $30,000 for failing the top-heavy test.

Example 2: $150k of unexpected contributions and penalties

A larger company has a total of $5,000,000 in its 401(k) plan, with key employees holding $3,200,000 (64%) of the assets. Here, the required minimum contributions for non-key employees amount to $100,000, but the company failed to make those contributions. As a result, the company could face a penalty of $50,000 (50% of the missed contributions) on top of the $100,000 in minimum contributions.

In both examples, the companies may also be subject to additional penalties, such as plan disqualification or excise taxes, which could further increase the financial burden.

Strategies to pass the 401(k) top-heavy test

There are several strategies that employers can implement to reduce the risk of their 401(k) plan failing the top-heavy test:

- Encourage Employee Participation: By encouraging all employees to participate in the retirement plan, the overall balance of the plan is less likely to be concentrated among key employees. This can be done through education, financial wellness programs, and adopting automatic enrollment (which nearly 6/10 companies did according to Vanguard’s 2023 How America Saves)

- Adopt a Safe Harbor 401(k) plan: As previously mentioned, Safe Harbor 401(k) plans are exempt from top-heavy testing if they meet specific contribution and vesting requirements. By adopting a Safe Harbor plan, employers can ensure that their plan remains compliant and provides equitable benefits to all employees.

- Implement a QACA: Adding a Qualified Automatic Contribution Arrangement (QACA) to your plan increases employee engagement and potentially reduces the risk of being top-heavy. As discussed in the following section, QACA plans must meet specific contribution and vesting requirements to be exempt from top-heavy testing.

- Regularly monitor plan assets: It's essential for employers to regularly monitor their plan assets and the distribution of those assets among key and non-key employees. By staying aware of the plan's status, employers can make timely adjustments to prevent the plan from becoming top-heavy.

- Restructure the plan: In some cases, it may be beneficial to restructure the plan to limit contributions that key employees can make. This can be achieved by setting lower contribution limits for key employees (see 2024 contribution limits).

Retirement plan options to avoid top-heavy tests

There are three common retirement plan types that can help employers avoid failing the 401(k) top-heavy test – however, they all require employers to make a retirement plan contribution, which can be expensive for many small businesses.

Under the right conditions, Safe Harbor 401(k) plans automatically pass top-heavy tests, providing small businesses with a streamlined, compliant retirement plan option.

Safe Harbor 401(k) plans

Safe Harbor 401(k) plans are exempt from top-heavy testing if they meet specific contribution and vesting requirements set by the IRS. These plans are designed to provide more equitable benefits for all employees, regardless of their position within the company.

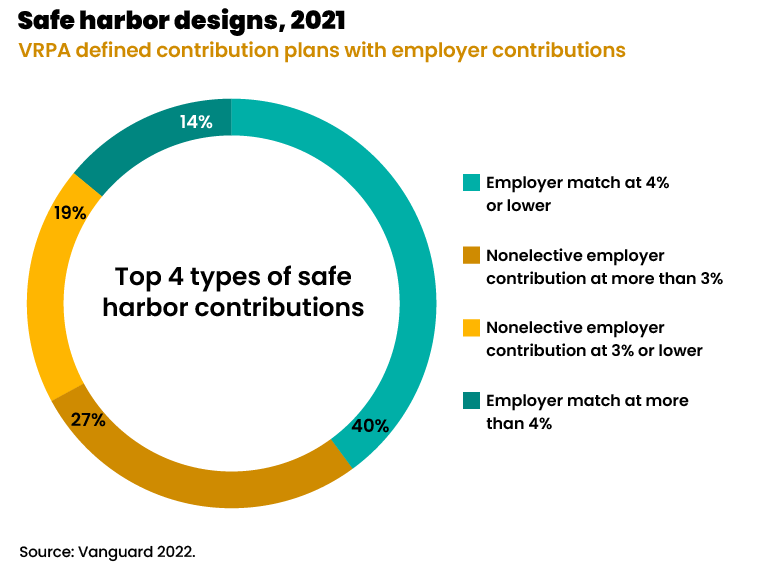

Safe Harbor 401(k) plans are a popular choice for small business owners and HR managers looking to simplify compliance and ensure equitable benefits for all employees. In fact, in Vanguard's 2022 report, more than 70% of small business plans were Safe Harbor.

These plans offer two primary contribution options: the Safe Harbor match and the non-elective contribution. With the Safe Harbor match, employers match their employee's contributions up to a specified percentage, typically 100% of the first 3% of salary deferrals and 50% of the next 2% of salary deferrals. On the other hand, the non-elective contribution option involves employers providing a flat percentage (usually 3%) of each employee's salary, regardless of whether the employee contributes to the plan.

By implementing one of these contribution structures and meeting specific vesting requirements, Safe Harbor 401(k) plans automatically pass top-heavy tests, providing small businesses with a streamlined, compliant retirement plan option.

Safe Harbor 401k pros and cons

Pros:

- Exemption from the three key 401(k) nondiscrimination tests: Safe Harbor 401(k) plans are exempt from top-heavy testing as well as the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests, simplifying compliance and reducing administrative burdens.

- Higher employee satisfaction: Safe Harbor plans often result in higher employee satisfaction due to employer contributions and immediate vesting, which can help attract and retain talent. In fact, a 2022 study found 68% of employees reported that the match was key to reaching retirement goals.

- Encourages employee participation: The required employer contributions can incentivize employees to participate in the plan, leading to a more balanced distribution of assets and a reduced risk of being top-heavy.

- Higher contribution limits: Unlike SIMPLE 401(k) plans, Safe Harbor 401(k) plans allow employees to contribute up to the standard 401(k) limits, providing greater flexibility and potential for retirement savings.

Cons:

- Mandatory employer contributions: Safe Harbor plans require employers to contribute at least 3% to every employee or match 4%, which can be a financial burden for small businesses with tight budgets.

- Immediate vesting: Safe Harbor 401(k) contributions must vest immediately, potentially decreasing the impact retirement contributions can have on employee turnover.

- Mid-year changes restriction: Making changes to a Safe Harbor 401(k) plan during the plan year can be challenging, requiring additional notices that often can only be made at year-end.

- You may get stuck with Safe Harbor: Employers only automatically pass the top-heavy tests while they have the Safe Harbor provisions in place. If an otherwise top-heavy plan removes its Safe Harbor provision for financial reasons, they may find themselves failing the top-heavy test and subject to unexpected contributions precisely when they can least afford it.

A SIMPLE 401(k) plan can be an effective strategy for avoiding the top-heavy test, particularly for small businesses with 100 or fewer employees.

Simple 401(k)

Another strategy for avoiding the 401(k) top-heavy test is implementing a SIMPLE (Savings Incentive Match Plan for Employees) 401(k) plan. This type of plan is designed specifically for small businesses with 100 or fewer employees. Let's take a look at the pros and cons of choosing a SIMPLE 401(k) as a strategy for avoiding the top-heavy test.

Simple 401(k) pros and cons

Pros:

- Simplified administration: SIMPLE 401(k) plans have fewer administrative requirements, which can reduce the burden on small business owners and HR managers.

- Reduced testing: SIMPLE 401(k) plans are not subject to the top-heavy test or other non-discrimination tests, making compliance easier to manage.

- Employer contributions: Employers are required to make either a dollar-for-dollar match on employee contributions up to 3% of their salary or a non-elective contribution of 2% of each eligible employee's salary, regardless of whether the employee contributes to the plan. These contributions can help encourage employee participation.

- Immediate vesting: Employer contributions to a SIMPLE 401(k) are immediately vested, which can be appealing to employees.

Cons:

- Lower contribution limits: SIMPLE 401(k) plans have lower annual contribution limits compared to traditional 401(k) plans. As of 2024, the annual limit for employee salary deferrals in a SIMPLE 401(k) is $16,000 (up from $15,500 in 2023), whereas the limit for traditional 401(k) plans is $23,000.

- Limited flexibility: SIMPLE 401(k) plans do not allow for additional employer contributions beyond the required match or non-elective contributions, which can limit the plan's overall flexibility and attractiveness to employees.

- Restricted to smaller businesses: SIMPLE 401(k) plans are only available to businesses with 100 or fewer employees, limiting their applicability for growing companies.

- No loans or rollovers: Unlike traditional 401(k) plans, SIMPLE 401(k) plans do not permit loans or rollovers from other retirement plans during the first two years of participation. In 2023, traditional 401(k)s allow loans up to $50,000 (or 50% of the vested account balance).

In summary, a SIMPLE 401(k) plan can be an effective strategy for avoiding the top-heavy test, particularly for small businesses with 100 or fewer employees. However, it's essential to weigh the pros and cons to determine if this type of plan is the best fit for your business and your employees' needs.

A QACA plan can be a useful strategy for avoiding the top-heavy test by encouraging employee participation and promoting long-term retirement savings.

Qualified Automatic Contribution Arrangements (QACA)

A QACA is an automatic enrollment feature that can be added to a 401(k) plan, increasing employee engagement and potentially reducing the risk of being top-heavy. QACA plans must meet specific contribution and vesting requirements to be exempt from top-heavy testing. Employers are required to contribute either:

A non-elective contribution of at least 3% of compensation for all eligible non-highly compensated employees

-or-

A matching contribution that satisfies the following requirements:

- 100% match on the first 1% of employee contributions, and

- 50% match on employee contributions between 1% and 6% of their compensation

QACA 401(k) pros and cons

Pros:

- Increased employee participation: QACA plans automatically enroll employees into the retirement plan, which can lead to higher participation rates. This can help balance the distribution of assets and reduce the likelihood of being top-heavy.

- Exemption from ADP testing: QACA plans are exempt from the Actual Deferral Percentage (ADP) test, which simplifies compliance and lowers administrative burdens.

- Employer contribution options: Employers can choose between matching contributions or non-elective contributions. A QACA match generally requires a 100% match on the first 1% of deferrals and a 50% match on deferrals between 1% and 6% of the employee's salary. Alternatively, employers can make a non-elective contribution of at least 3% of each eligible employee's salary.

- Encourages retirement savings: Automatic enrollment and escalation of employee contributions help encourage long-term retirement savings and financial wellness.

Cons:

- Required employer contributions: Like Safe Harbor 401(k) plans, QACA plans mandate employer contributions, which, unfortunately, may prove to be a financial challenge for some businesses.

- Administrative complexity: Implementing a QACA plan can add administrative complexity due to the automatic enrollment and escalation features, requiring diligent monitoring and management.

- Opt-out and escalation concerns: While automatic enrollment can boost participation, employees may not actively engage in managing their investments or may choose to opt-out. Additionally, automatic escalation may lead to employee concerns if they are not aware of the increases or do not fully understand the benefits.

- Vesting schedule: QACA plans allow for a two-year cliff vesting schedule for employer contributions, which means that employees must complete two years of service before becoming fully vested. This vesting schedule may be less attractive to employees compared to immediate vesting in Safe Harbor 401(k) plans.

In summary, a QACA plan can be a useful strategy for avoiding the top-heavy test by encouraging employee participation and promoting long-term retirement savings. However, it is important to weigh the pros and cons to determine if this type of plan is the best fit for your business and your employees' needs.

Side-by-side comparison of 401(k) top-heavy plan design options

Conclusion

Understanding the 401(k) top-heavy test, its consequences, and the various alternatives available, can help employers maintain a balanced and compliant retirement plan. By leveraging Safe Harbor 401(k) plans, Qualified Automatic Contribution Arrangements (QACA), and other strategies, employers can minimize the risk of facing top-heavy 401(k) consequences while providing equitable benefits to all employees.

How ForUsAll can help you pass the top-heavy test

ForUsAll offers comprehensive retirement plan solutions that can help employers navigate the complexities of top-heavy testing and create a retirement plan that benefits all employees. Our platform helps monitor top-heavy status throughout the year – preventing surprises at the end of the year. In addition, ForUsAll is particularly skilled at achieving high levels of employee participation, significantly reducing the chance that a plan becomes top-heavy.

We are committed to helping employers navigate these complexities and create a retirement plan tailored to their specific needs. By monitoring top-heavy status throughout the year and emphasizing high levels of employee participation, ForUsAll ensures that your 401(k) plan remains compliant and serves the best interests of your entire workforce. Contact us today to learn more about how our retirement plan solutions can help your business succeed.