401(k) Nondiscrimination Testing: What is it & How to Improve Your Results

Is your company’s 401(k) plan fair? Does every employee have an equal shot at saving for retirement, or are highly-paid workers and owners reaping more of the benefits? Tough questions for sure, but the IRS has developed three annual compliance tests to answer just that.

Hence, we bring to you this comprehensive guide, unraveling every aspect of the 401(k) nondiscrimination tests. We will delve into each test's specifics, application methods, implications of failure, and available remedies.

To make getting the information you need faster, here are links to some of the most common topics:

- What are 401(k) Nondiscrimination Tests?

- Key Definitions: HCEs, NHCEs, and Key Employees

- Standard Nondiscrimination Tests: ADP, ACP, and Top Heavy Tests

- NDT Deadlines and Due Dates

- Safe Harbor Plans and Nondiscrimination Testing

- How to Fix Failed Nondiscrimination Testing

We won’t hold you up any longer. Here’s everything (else) you need to know about 401(k) nondiscrimination testing:

What are 401(k) Nondiscrimination Tests?

Nondiscrimination tests (NDTs) are annual tests required to ensure that 401(k) retirement plans benefit all the employees, (not just business owners or highly-paid employees). These tests basically separate eligible employees into two groups: owners, highly-compensated employees, and everyone else. To pass these tests both groups need to join and save at roughly similar rates.

More specifically, these tests first separate employees into a few groups:

- Highly Compensated Employees (HCEs)

- Key Employees

- Non-Highly Compensated Employees (NHCEs)

- Non-Key Employees

The nondiscrimination tests then assess various factors:

- The percentage of income employees defer,

- The company's contributions to employee accounts,

- The share of total plan assets belonging to HCEs and Key Employees.

As per the IRS 401(k) Plan Overview, these tests "confirm that deferred wages and employer matching contributions do not discriminate in favor of highly compensated employees."

Businesses offering a 401(k) plan must pass two primary nondiscrimination tests annually:

In addition to these, most plans need to pass a third compliance test annually, known as the Top-Heavy test, which looks at the percentage of assets owned by Key Employees.

Failing to meet the IRS’s standards can mean fines, penalties, and bureaucratic headaches.

Why are nondiscrimination tests required?

Passing nondiscrimination tests shows that your 401(k) does not favor highly-compensated employees.

The government of the United States provides significant tax benefits via the use of 401(k) retirement plans. Given these benefits, the government wants to make sure that 401(k) plans DO NOT favor business owners, highly-paid executives (Key employees), and highly-compensated employees (HCEs).

In the IRS’s view, favoring HCEs/Key Employees is “discriminating,” and a series of annual tests attempt to highlight “discrimination”. It is the employer’s responsibility to either: (1) pass these nondiscrimination tests, or (2) if they fail these tests, take the appropriate remedial actions.

Plans that do not remedy NDT testing failures may lose their qualified plan status.

The plan's ability to pass these tests depends on factors like employee participation, the amount they defer, and the company's contributions.

High participation helps you pass annual compliance tests

While joining a 401(k) plan is optional, the participation rate significantly influences whether a plan will pass nondiscrimination testing. Studies reveal that plans with automatic enrollment boast a 92% participation rate compared to 62% for plans with voluntary enrollment.

If certain employees, especially those with lower incomes, don’t participate due to financial constraints, lack of interest, or unawareness, the plan may fail a nondiscrimination test due to high participation among HCEs and Key Employees.

Employer Contributions and their Impact

The way a company contributes to its employees' 401(k) savings primarily impacts the ACP nondiscrimination test. There are two types of contributions:

- Matching Contributions: Company contributions made based on how much employees choose to defer.

- Nonelective Contributions: Made regardless of whether an employee defers income to their 401(k).

Plans that provide a 401(k) match are more likely to fail the ACP test, because receiving the match requires employees to save into the plan. If participation is low, then many eligible employees will not get the match. With a nonelective, every employee receives the same match, regardless of how much they save, making it much easier to pass the ACP test.

Leveraging either aa Safe Harbor Match or a Safe Harbor Nonelective contribution, allows you to automatically pass the ACP test.

Common Struggles With Nondiscrimination Testing

These tests weren’t built with small businesses or startups in mind, and this means these small (and medium-sized) businesses can struggle much more with passing their NDTs - especially the dreaded Top Heavy test (which we’ll cover more below).

Small and medium-sized businesses face unique challenges passing these tests:

- They may have a relatively high number of HCE’s.

- Family-owned businesses may have high proportions of key employees because some family members may be treated as Key Employees even if they don’t make much money or own any interest in the company.

- Early-stage startups might have early employees and founders that don’t make much salary but whose stock options make them owners (even if they haven’t exercised their options). Moreover, startups don’t typically have enough funding to offer a company match, making Safe Harbor plans out of reach.

Nondiscrimination Testing Rules: Who is an HCE, NHCE, or Key Employee?

Much of what you have to deal with in nondiscrimination testing has to do with which employees are highly-compensated, which are not, and when those distinctions change. To make it easy, we’ve laid out exactly what determines a person’s classification as a highly-compensated employee, a non-highly compensated employee, or a key employee below.

Highly-Compensated Employees (HCEs)

A highly-compensated employee is more or less what it sounds like, although the IRS has specific requirements that must be met in order to qualify as one (for the purposes of your 401(k) retirement plan).

Nondiscrimination testing requirements for HCEs:

— owned more than 5% of the interest in the business at any time during the year or preceding year, regardless of how much compensation (wages, salaries, bonuses, tips, or fringe benefits) they received.

— certain family members of 5% owners (more on that below)

— made more than $155,000 in 2024 (up from $150,000 in 2023).*

*The Top Paid Election for HCEs

Companies with a large proportion of HCEs have the option to use the “Top Paid Election,” in which the top paid group is the top 20% when ranked by compensation. This isn’t the standard, but it can be useful when your company has a high number of HCEs in comparison to NHCEs.

Non-Highly Compensated Employees (NHCEs)

This categorization is slightly easier (at least on the surface).

All your eligible employees that don’t fit the above HCE requirements are considered non-highly compensated employees or NHCEs. Pretty simple. But it does get a bit more complex, so bear with us.

Determining who’s an NHCE isn’t always as easy as looking at everyone’s job description and salary and checking them off. Newly hired employees who would traditionally qualify as HCEs but who have not been with your company long enough to be paid the required $155,000+ a year will count as NHCEs until the year after they exceed the threshold.

Key Employees

Key employees are another category to be aware of, and there are several ways that both highly and non-highly compensated employees can qualify as “key.”

Nondiscrimination testing requirements for a Key Employee:

- Any company officer (CEO, CFO, etc) who has a compensation of $220,000+ in 2024 (up from $215,000 in 2023).

- Any employee who owns more than 5% of the company, OR is the parent, child or spouse of someone who owns more than 5% of the company.

- Any employee who owns more than 1% of the company AND earns more than $150,000.

Naturally, HCEs are often key employees, but NHCEs can be key employees even if they don’t meet the compensation requirements, due to the fact that they are related to someone who owns more than 5% of the company.

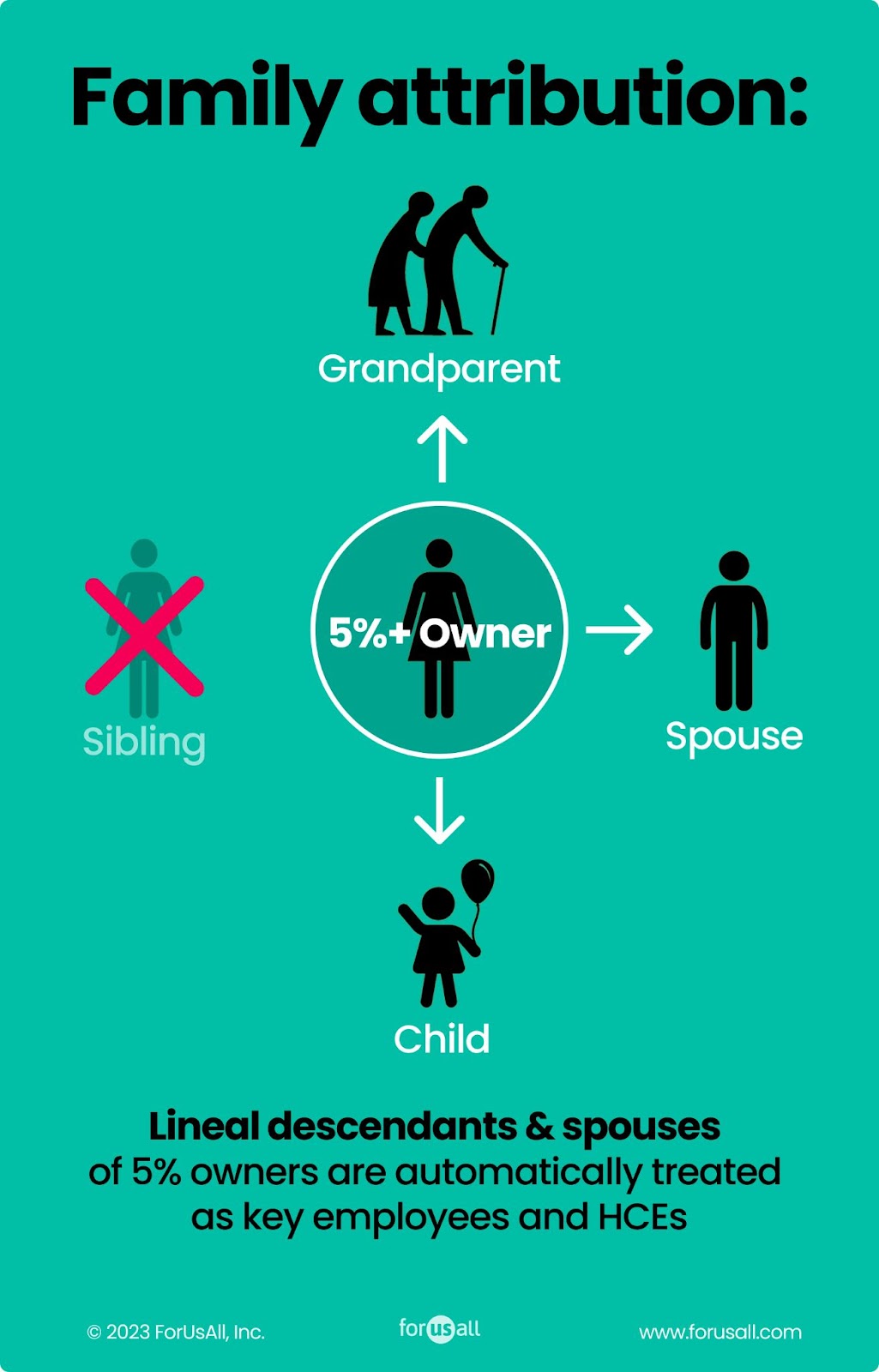

Family attribution rules for nondiscrimination tests

Family owned businesses need to pay special attention, due to family attribution rules. Parents, children and spouses of any 5% owner may be automatically treated as Key Employees or HCEs – even if they don’t meet the ownership or income requirements.

Always be sure to share any familial connection to your plan provider so that you properly classify and track the impact family members may have on your annual 401(k) compliance tests.

Important Nuance: HCE and NHCE Categorization is Based On Prior Year Compensation

Because of the difficulties that arise in dealing with up-to-date employment fluctuation and retirement reporting, these calculations may be based on the prior years’ compensation if this is allowed in the Plan Document.

When using the prior year’s information, you’ll also be comparing average contribution rates from the prior calendar year, not the current year. This is also handy for knowing your HCE contribution limits beforehand, reducing the risk of needing to refund HCE contributions later down the line.

New 401(k) retirement plans naturally can’t use the “prior year” information. In these instances, IRS regulations let you use 3% as the NHCE average deferral percentage, meaning your HCEs will have a maximum contribution of 5%.

New 2024 Limits For Key Employees and Highly Compensated Employees

The IRS changes income limits for Key Employees and HCEs periodically and 2022 values may still apply depending on the testing methods you choose (more on that below).

Standard Nondiscrimination Testing: ADP, ACP, and Top Heavy Tests

Actual Deferral Percentage (ADP) Test

The actual deferral percentage test or ADP test is our first nondiscrimination test. This test compares average NHCE salary deferral percentages to the average for the HCEs, and naturally involves the calculation of these numbers.

Calculate these two percentages:

Step #1: Calculate Annual HCE Deferral Rate

Gather together your HCE contribution rates and average them. Display as a percentage.

ADP for HCEs = Salary Deferral / Total Compensation

Step #2: Calculate Annual NHCE Deferral Rate

Gather together your NHCE contribution rates and average them. Display as a percentage.

ADP for NHCEs = Salary Deferral / Total Compensation

Step #3: Compare and Make Your Determination

Compare the percentages and be sure that they fall within the acceptable ranges.

The annual maximum HCE deferral rate is based on the contribution rates of your NHCEs. Here’s how to determine the maximum HCE rates:

For example, if:

- NHCEs save 1% on average, then HCEs save more than 2%, on average.

- NHCEs save 7% then HCEs can’t save more than 9%, on average.

- If NHCEs save 12% then HCEs can’t save more than 15%, on average

Actual Contribution Percentage (ACP) Test

We’ve already gone over the ADP, so the ACP will be a piece of cake.

The actual contribution percentage (ACP) test is just the ADP test, but created to include employer match contributions and any after-tax contributions employees make. To that end, you follow the same basic procedure:

Step #1: Calculate Annual HCE Contribution Rate

Gather together your HCE matching or after-tax contribution rates and average them. Display as a percentage.

HCE ACP = (Salary Deferrals + Employer Contributions + After Tax Contributions) / Total Compensation

Step #2: Calculate Annual NHCE Contribution Rate

Gather together your NHCE matching or after-tax contribution rates and average them. Display as a percentage.

NHCE ACP = (Salary Deferrals + Employer Contributions + After Tax Contributions) / Total Compensation

Step #3: Compare and Make Your Determination

Compare the percentages and be sure that they fall within the acceptable ranges for the ADP test.

Failed this test? Worried about what to do? Skip to this section on what to do if you fail your NDTs.

Top-Heavy Test

Determining if a plan is top-heavy is actually pretty simple. Here’s the basic requirement:

If the sum of all key employee account balances is greater than 60% of the total retirement account plan balance, the plan is top-heavy.

To find if your plan is top heavy:

Step #1: Gather Key Employee Account Balances

Total the account balances of the key employee participants in your plan as of the end of the plan year.

Step #2: Determine the Percentage of Account Balance Contributed By Key Employees

Divide the total key employee account balance by the total account plan balance, and express this number as a percentage.

Step #3: Check the Result

If the result of the above calculation is greater than 60%, the plan is top-heavy, and steps must be taken.

How Frequently Should I Perform 401(k) Nondiscrimination Tests?

As we mentioned above, using the prior year’s data can help you determine HCE contribution maximums ahead of time. Occasional checks to your nondiscrimination status are also an excellent way to prevent unexpected paperwork and unhappy employees down the road. Annual testing is essential, but ideally you are monitoring the situation throughout the year.

Traditionally, NDTs are done on the last day of the plan year (or the beginning of the next) to get all the data. We also recommend at least a mid-year, and surprise assessment at a random point during the year.

Why the surprise test? You may be able to take preventative action that can help you pass the test and avoid a potentially costly correction. For instance, if you fail the top heavy test mid-year, you can limit HCE contributions until the plan passes. You can also prohibit HCEs from contributing in the next plan year. If you don’t do either of these things, you’ll have to make a 3% nonelective contribution to all eligible participants.

While we’re talking about that, it might be a good idea to bookmark this article if you’ve found it useful so far.

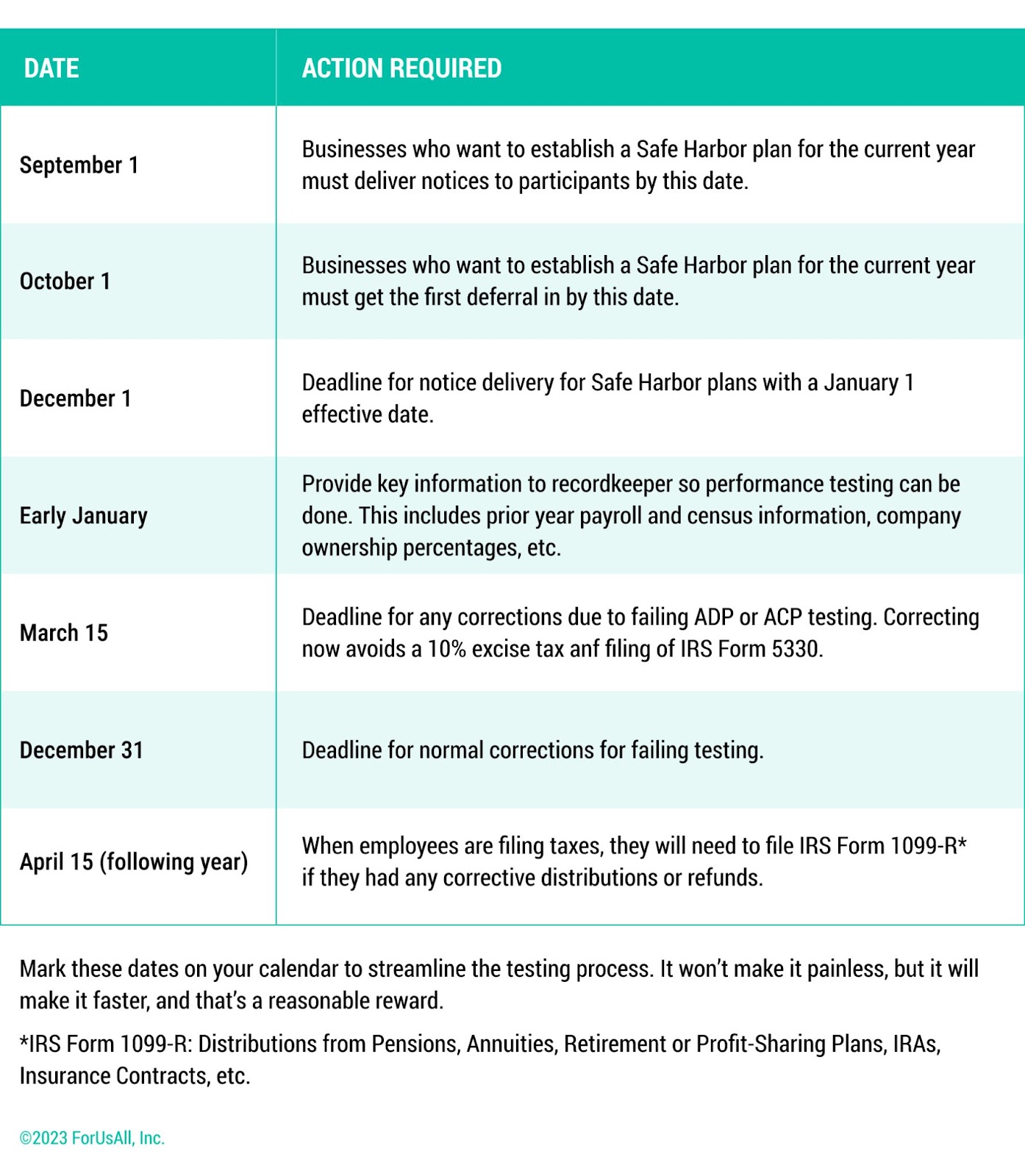

Important Nondiscrimination Testing Deadlines to Know

Staying on top of important testing deadlines is important, not only for your own stress management, but also to help your employees optimize their retirement accounts.

To that end, here are the dates you need to know about for your nondiscrimination testing:

My 401(k) Plan Failed Nondiscrimination Testing — What’s Next?

Step #1: Check Again — Using a Different Test Method

A knowledgeable retirement advisor or 3(16) fiduciary can sometimes help your plan pass by using a testing method that’s different from a typical nondiscrimination test. If your plan is on the border, this might help you squeeze past even if you’ve failed your standard test

After all, it never hurts to check, right?

A technically savvy 401(k) advisor may be able to get your plan to pass using a testing method different from the one you have customarily used.

If you still failed, it’s time to proceed to Step #2, because you’ll need to take action as soon as possible. Even if you passed with this little trick, you’ll still want to look into Step #3. You don’t want to deal with this same anxiety again, so preempt it with a little bit of proactivity.

Step #2: Take Corrective Action Immediately

If your plan failed nondiscrimination testing, you have to take corrective action. Luckily, there are several options for doing this. These include:

- Making Corrective Distributions: corrective distributions are when you refund the contributions from HCEs until the plan passes the test. HCEs will receive refunds in the order of deferral amount. Since 2008, these refunds have been taxable in the year they are made.

- Making QNECs: Make a qualified non-elective contribution (QNEC), which is an employer contribution made on behalf of all eligible employees — regardless of how much they contributed to the retirement plan.

- Making QMACs: Make a qualified matching contribution (QMAC), which is an employer matching contribution that is only made to employees based on how much of their salary they deferred.

Those last two options are less popular, as they tend to be more expensive and less convenient.

Though we’ve laid out deadlines, it’s important to stay aware of plan specifics. Your plan documents will lay out the details on a “statutory correction period.” This is the period that you have to take necessary action for your plan to pass nondiscrimination testing. Abide by this carefully.

Step #3: Fix Your Plan — Encourage Participation and Contribution

It might seem sappy (or strange) to say that the best bet for improving your NDTs is by encouraging and inspiring your employees, but we’d argue it’s absolutely true. Encouraging your NHCEs to contribute to their 401(k)s actually achieves several goals:

- Healthier proportion of NHCE to HCE 401(k) contributing to the plan.

- Stress-free nondiscrimination testing.

- Better employee financial wellness.

- Potentially, helps you retain employees. Based on a study of over 5,000 employees, we’ve seen that eligible employees who participate in the 401(k) had an 11% higher retention rate than those that didn’t.

401(k) participation is a major topic – one which we’ve discussed in detail here at ForUsAll. If you want to learn more about how to improve your 401(k) participation, check out this blog post on how to achieve 90% 401(k) participation rates.

Three Strategies to Help Pass Nondiscrimination Tests

Get high participation rates

The key to helping all employees join and save at high rates is making it easy to join, providing personalized education, and effective, ongoing monitoring.

- Make joining so easy, it's automatic: Automatic enrollment can help boost plan participation rates among NHCEs. In fact, a 2021 study found that 9/10 stay in the plan, and 84% of employees said: “auto-enrollment is key to saving earlier”.

- Proactive, personalized communications: Provide engaging communications (email, online tools, and even text messages) to make sure employees know about and are excited by the plan. Make sure your provider personalizes the communications.

- Holistic financial help: Many employees may not feel confident saving if they are struggling to make ends meet. Choosing a provider that can provide holistic help with budgeting, debt, college funds, etc., can make a big difference.

- Limit HCE contributions: If necessary, restrict the contributions of HCEs to maintain a more balanced contribution ratio between HCEs and NHCEs. This can be an effective, albeit less popular, method.

- Monitor throughout the year: Regularly review plan participation and contribution data to identify potential issues with the ADP and ACP tests. By identifying concerns early, you can make adjustments before the end of the plan year to improve the likelihood of passing the tests.

Perform Mid-Year Compliance Testing

Nobody is happy when you fail year-end compliance testing, and if you think you might have trouble passing, we recommend you proactively test mid-year. The early sooner you know, the sooner you can present your forecast to the executive team and propose proactive strategies which could include:

- Instituting automatic enrollment or auto escalations

- More education and outreach to NHCEs

- Capping contributions for HCEs

- Budgeting for mandatory contributions.

Adopt a Safe Harbor Plan

If you are looking to bypass ADP and ACP tests entirely, you can consider a Safe Harbor 401(k). These 401(k) retirement plans include an IRS-qualified employer contribution by default, and are exempt from the 3 major NDTs (unless there’s a profit-sharing component to the plan).

In addition to skipping most nondiscrimination tests, Safe Harbor plans with a matching contribution encourage your employees to contribute to the plan, making your 401(k) another weapon in your recruiting and retention arsenal.

In order for a plan to qualify as “safe harbor,” it (like everything else in this post) has to make one of these typical contributions:

The business matches 100% of employee retirement plan contributions up to 4% (can be up to 6% of plan sponsor chooses)

OR

The business matches 100% of employee retirement plan contributions up to 3%, as well as a 50% match of the next 2%.

OR

The business contributes 3% of every employee’s compensation, regardless of whether the employee actively contributes to their 401(k) plan

Avoid the costs of non-compliance:

Passing nondiscrimination testing is essential.

Failing a 401(k) nondiscrimination test means headaches and expenses not just for the company, but potentially for employees as well. Still, don’t let that stress you out. You’ve now got all the tools you need to face this particular 401(k) plan administration challenge.

In this post we’ve covered definitions, tests, timelines, alternatives, and what to do in case of a failed test – but that’s still not everything about nondiscrimination testing. If you’ve still got questions, let us know. We’re here to provide answers. Reach out any time to info@forusall.com.

Conclusion:

Passing nondiscrimination testing is essential.

Failing a 401(k) nondiscrimination test means headaches and expense not just for the company, but potentially for employees as well. Still, don’t let that stress you out. You’ve now got all the tools you need to face down this particular 401(k) plan administration challenge.

In this post we’ve covered definitions, tests, timelines, alternatives, and what to do in case of a failed test – but that’s still not everything about nondiscrimination testing. If you’ve still got questions, let us know. We’re here to provide answers. Reach out any time to info@forusall.com.