404(a)(5) Participant Fee Disclosures: Rules & Requirements

Understanding and eliminating unnecessary 401(k) plan fees may be one of the most important aspects of investing. A simple 2% fee can reduce retirement account earnings by as much as 50% over a 35-year horizon.

The Department of Labor (DOL) requires 401(k) providers to send fee disclosures to employees and plan administrators. This helps both parties make informed decisions about the plan. This post will discuss the 404(a)(5) fee disclosure and key disclosure rules and requirements. We will also highlight the new ways the Department of Labor (DOL) allows employers to send them.

What is a 404(a)(5) Participant Fee Disclosure?

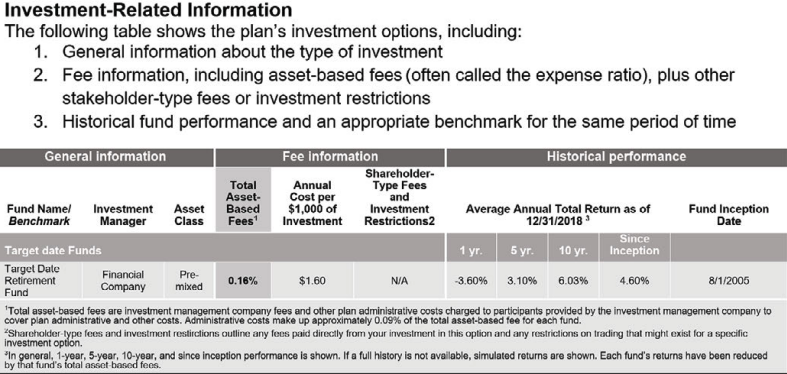

404(a)(5) Participant Fee Disclosures provide fee transparency by showing the fees and expenses of the retirement plan. Sponsors must send the 404(a)(5) fee disclosures to retirement plan participants at least annually. These notices outline retirement plan fees and expenses, including:

- investment options ("designated investment alternatives"),

- investment fees

- administrative fees

- Transaction fees

- Self-directed brokerage account fees (trading fees, account maintenance fees, etc.)

- Other investment-related information

The Employee Retirement Income Security Act (ERISA) requires these disclosures so participants know the fees charged.

Who is responsible for 404(a)(5) Disclosures?

401(k) recordkeepers and third-party administrators typically prepare these required notices. However, employers must send them to participants or confirm that their provider has.

Who must receive the 404(a)(5) disclosures?

Section 2550.404a-5 of ERISA requires notices for any participant-directed individual account plan. This includes 401(k) plans and many profit-sharing plans. The regulations require plan administrators to send these disclosures to each participant or beneficiary.

Required Timing

Sponsors (or their providers) must send these 401k fee disclosures:

- Before eligible employees can join the plan and choose their investments

- At least once per year

- Within 30 to 90 days of important changes to the plan or plan investments.

If the change is unexpected, the plan administrator must send the notices as soon as practical.

Required Quarterly Fee Information

Additionally, providers must provide employees with a statement of "Actual Charges or Deductions" at least quarterly. These statements should contain information including the dollar amount of plan-related fees and a description of services.

Important Note: Do NOT attempt to change or correct notices yourself. If you notice incorrect information, reach out to your recordkeeper or TPA. The documents can be particularly complicated, and making an honest mistake could create unnecessary legal risk.

What are permissible ways to send participant fee disclosures?

While plan sponsors must ensure participants receive these notices, they can delegate this responsibility to their providers. Sponsors can send these notices electronically (online or via email), provided they meet the new e-delivery requirements released in 2020.

Before 2020, employers could only send electronic notices if employees were "wired at work":

- Participants must have access to a work computer

- OR participants must have access to a computer at work

- OR they must have proactively chosen electronic delivery

The e-delivery standards allow more workable e-delivery via either:

- A "notice-and-access" framework that allows them to post the notices on a website.

- Direct-email delivery

In short, participants must have reasonable access to fee disclosure information.

Why 404(a)(5) Disclosures Matter

For decades, many 401(k) plans have paid unnecessary fees to the detriment of employers and employees. Fee transparency allows employers to identify and eliminate hidden fees. Transparent fees also help retirement investors pick the best options. By reducing unnecessary fees, employees can grow their savings faster - the whole point of 401(k) retirement savings.

The DoL estimated $14 billion in savings to participants in 10 years from clearer 401(k) fees.

Why 404(a)(5) fee disclosures fail to provide transparency

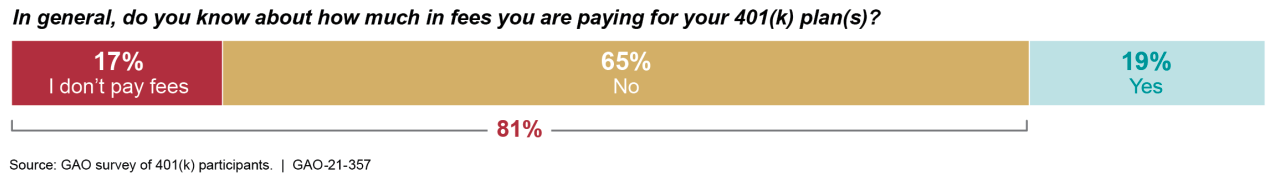

Notwithstanding the DOL's estimates, there is ample reason to believe that the goal of fee transparency is still out of reach. In 2021, the U.S. Government Accountability Office (GAO) conducted a large study to assess the efficacy of current fee disclosures. The GAO found nearly half (45%) of participants could not use the disclosure to determine their fees. More concerning, 81% incorrectly believed there were no fees or did not know.

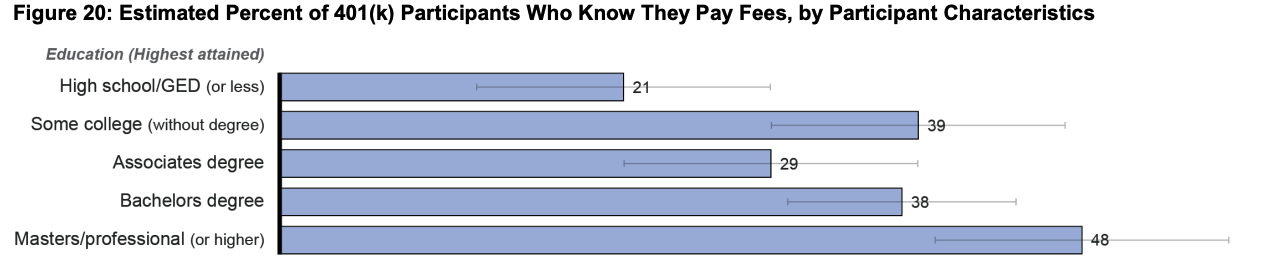

Over half of employees across education levels did not know they paid fees.

Key GAO recommendations to fix fee disclosure requirements:

- Require fee benchmarks

- Include mutual fund tickers to help employees compare fees online

- Use consistent terms for asset-based fees

- Require that provides show the cumulative effect of fees over time

But that just scratches the surface. These disclosures can easily span 10 pages or more and often have fees split up across multiple sections. Smart investors need to thoroughly review every page (including footnotes) to accurately determine plan costs.

Employer's Fiduciary Responsibility To Monitor Fees

Plan sponsors must act in the participant’s best financial interest ("Duty of Loyalty"). That means asking yourself the all-important question... “Are my plan participants paying reasonable fees?” But it also means diligently documenting your processes to ensure you understand fees and benchmarked them. Not ensuring your employees pay fair fees harms their retirement and can make the company legally responsible.

Indeed, in 2022, plaintiffs filed 89 excess fee and fiduciary imprudence cases. 2023 complaints are making more compelling arguments asserting "more credible recordkeeping claims based on plan services."

Conclusion

Retirement plan participants have the right to know exactly how much their 401(k) costs. They need to be able to compare fees and analyze their investment options to make smart investing decisions. 401(k) Fee Disclosures, like the 404(a)(5), have improved, but recent GAO studies show they still don't meet expectations.