CalSavers vs 401(k): Weighing the pros & cons for your business

Think it doesn’t matter whether you choose to join CalSavers or add a 401(k) plan? Think again:

Four out of five employees surveyed (79%) prefer benefits over a pay raise — for nearly a third of those (31%), that means a retirement plan like the 401(k). (1)

Setting up a good retirement plan is time well spent. It helps to attract top talent and retain loyal employees. But the key word here is “good.” For your employees, a good plan makes it easy to save, has high-quality and low-cost investment funds, and offers access to advice. For you, a good plan is easy to administer, can be customized for your business, and comes with tax advantages.The modern 401(k) plan from ForUsAll checks all of these boxes. Here’s a side-by-side comparison of the CalSavers plan (a Roth IRA managed by the state of California) and the 401(k) plan available from ForUsAll.

First, weigh the pros and cons for you and your business:

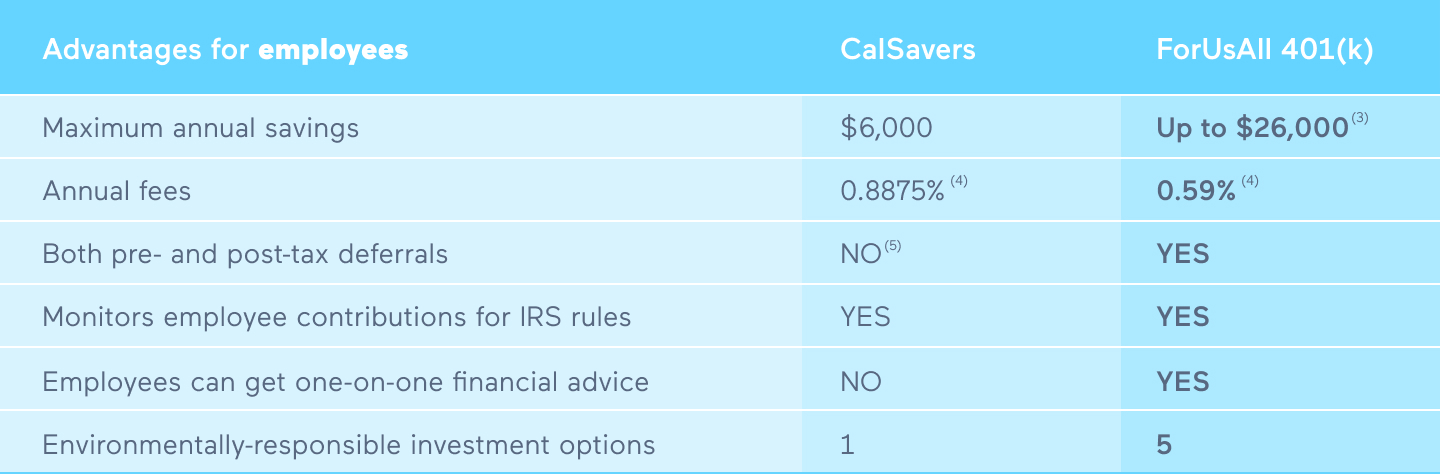

Next, look at it from your employees’ perspective:

Get started today. The CalSavers deadline is June 30, 2021, if you have 50 or more employees in California (6). We can help you avoid CalSavers fines and help you qualify for tax credits, while giving your employees a better way to save for retirement.

(1) “4 in 5 Employees Want Benefits or Perks More than a Pay Raise: Glassdoor Employment Confidence Survey (Q3 2015),”

(2) Employers are eligible for up to $5,000 tax credit per year for 3 years, up to a maximum tax credit of $15,000. Full details here.

(3) CalSavers-compliant 401(k) maximum savings per year: $19,500 for savers under 50 years of age, and $26,000 for savers 50 years of age and over.

(4) Average of asset-based fees + fund fees (may change based on fund allocation).

(5) CalSavers Roth IRA allows post-tax deferrals only, however, employees may convert their Roth deferrals to pre-tax at any time.

(6) If you have five or more employees, the deadline is June 30, 2022.