As one of the largest and fastest growing 401(k) advisors in America, we work with hundreds of plan sponsors and tens of thousands of participants.

The number one question we hear from existing and potential customers is "Which 401(k) plan providers should I consider?" It's an important decision for any business, and there are lots of options. In fact, there are more than 100 401(k) recordkeepers in the US, with dozens operating in all 50 states.

To winnow down that list for small to medium sized businesses, we considered a number of different factors:

- How large is the provider, and how quickly is it growing?

- How popular is the provider? Does it have a brand that your employees recognize and get excited about?

- What about help for employees to get on track for retirement? What is the quality of tools that the recordkeeper provides?

- And of course, what is the cost for you and your employees?

This post, will share our top recordkeeper picks and cover how they serve participants.

The Top 10

All of our top 401(k) recordkeepers provide high quality tools and service. The recordkeeper that's going to be the best fit for your company is largely going to be dependent on what your employees' needs look like and what resources you need as a plan sponsor.

Making the recordkeeper decision is a huge one. According to U.S. News & World Report, nearly one out of two employees is unhappy with their retirement plan.

Now more than ever, the quality of the benefits you provide is critical in attracting and retaining top talent. When asked, 90% of millennials said that they would prefer better benefits over more pay.

Why Choosing a Good 401(k) Provider Matters

It used to be that employees who were dissatisfied would gossip about it at the water cooler. But now the stakes are higher. The concern isn’t that they're complaining in the break room, but that they're going online to post their discontent for all the world to see.

Before applying to a company, prospective employees will research it on Google and Glassdoor. And they are likely to see what your current employees say about the benefits you offer.

They may complain about the investment expenses of the recordkeeping services and the variety of mutual fund options that are in the plan. They may also highlight how those expenses are impacting how much they will be able to save for retirement.

Alternatively, when employers create a good 401(k) program, employees may similarly go online and rave about the benefits. That means that right now, the stakes for choosing the right 401(k) plan are really high.

In fact, Google's Glassdoor page highlights the fantastic job that they've done. They get nearly five out of five stars for their 401(k) plan. Employees are raving not just about the recordkeeping services, but the low cost of the investments and other key plan features.

What are Employees Looking For?

Across industries, we’ve found that employees are looking at three key things in a 401(k) provider: the strength of its brand, the quality of its participant tools, and the existence of key features that support critical needs, such as student loan help and Spanish language support.

Best at Digital Investing: Vanguard

While Robinhood may be all the rage for democratizing online investing, it’s still Vanguard that holds the No. 1 spot for best brand in digital investing, according to Harris Interactive. Vanguard’s low-cost platform makes it easy for people to invest and save.

Great 401(k) Provider Websites

There's really a broad range of approaches to 401(k) websites. On the one hand is Empower, who has taken very sophisticated and detailed planning tools and made them a core part of the experience.

On the other end of the continuum is Vanguard, which follows a principle they call “simple by design.” They have all of the same tools and functionality, but it's much more in the background. In between those two are companies like John Hancock. It’s not that one approach is right and another approach is wrong. It's a question of which approach is going to be best for you and for your employees.

The key is how financially savvy your employees are and how comfortable they are with taking a hands-on approach to their retirement planning.

Empower's Website

With Empower, the retirement income forecast is the focal point of the experience. They provide a detailed forecast of what that income is going to be, based on multiple sources of income, including your HSA or Social Security.

The Empower site allows you to visualize how you can close your retirement gap. By increasing your savings or by changing your retirement age, you can begin to shrink the gap, create a plan that will get you on track, and then implement that plan with a single click. You can also see how you’re doing compared to other people your age, with your income or even what they call top peers.

The sophistication of these tools is prominently displayed on the site. However, a lot of people can get intimidated by these types of tools, so Empower might not be the best fit for everybody.

John Hancock's Website

With John Hancock, the experience is much easier to digest. The home page features your current balance and shows your progress toward your retirement goals. You can also upload a picture to visualize what retirement means to you.

The retirement planning tools are just a click away. The tools make planning personal for each participant and provides suggested contribution level guidance that can be easily implemented in just two clicks.

Then, they’ll show what you're on track to receive in retirement income. From there, you can use the financial wellness assessment, which is a quiz that generates a wellness score. The wellness quiz will provide some specific suggestions on how the employee can do better as an investor.

What’s Best for Your Employees?

The best solution for your employees depends on what they want from the tools. For example, if an employee logs on and immediately sees that they’re behind in retirement, it could go one of two ways.

It might be a motivator for them to start saving more, but it could also be demoralizing for employees who feel that the gap is so insurmountable that they might as well give up. Employers have to be thoughtful and consider the best solution to engage their employees further.

401(k) Provider Mobile Apps

Most recordkeepers also offer mobile apps. We’ve picked out two we really like.

ADP

ADP's mobile app takes a question-based approach to planning. As you use the tool, you get more suggestions on what to do. Once your participants become eligible, ADP will email a link to the app to your participants, so they can install it.

The app starts by asking questions like your current income, when you want to retire, where you will live in retirement, etc. Based on the answers, you get a retirement goal, along with suggestions on how to get on track to reach that goal.

Vanguard

Vanguard's mobile app, ReadySave, is more of a behavior-based feedback system. It relies on a lot of behavioral economic concepts. As you make changes, it will provide subtle cues that demonstrate if they’re good or bad. You can monitor your progress through the forecast.

Support for Student Loans

Student loan help has become a huge issue in recent years, as the number of people that are dealing with student debt is growing. It’s really hard for graduates to balance saving for retirement while also making monthly payments on their student loans.

Thankfully, we’ve seen both sponsors and record keepers provide more help in this area. There are three main ways they can help:

Advice:

Many 401(k) providers offer advice on how best to repay student loans.

Refinance:

We’re seeing many recordkeepers partnering with other financial institutions to provide student loan refinancing, so students can refinance their loans to get a better interest rate or lower payment.

Payment matching:

Some employers are offering student loan matching, where an employer can choose to match an employee’s student loan payment with a contribution into the 401(k) plan. The match program is a great way for employers to help employees start saving for retirement while also making progress on student debt.

However, not all of these options are available from all of the recordkeepers. Principal and Empower offer all three types of help, but others aren’t offering any student loan help.

If you’re a plan sponsor, and you have a large number of young people in your plan or you're heavily recruiting people out of college, student debt might be a really important consideration.

Spanish Language Support

Some, like Principal, Empower, and Fidelity, have gone the extra mile to make the website, mobile app, and statement notices available in both English and Spanish.

But some 401(k) providers have done nothing in this area. This is an important consideration for some plan sponsors, and we know that this has been very meaningful to those for whom English isn’t their primary language.

Many companies have employees that are bilingual, but they still appreciate financial communication in Spanish, because they can be sure that they understand everything. That ease ultimately reflects back onto the sponsor.

Will Your Employees Use The Participant Tools?

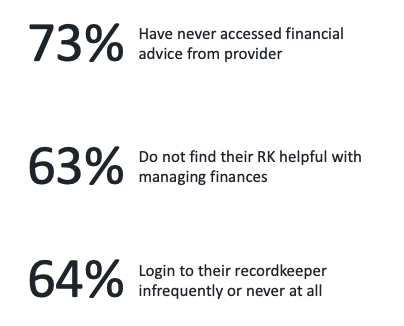

According to PlanSponsor, just 27% of retirement plan participants surveyed said they have accessed professional financial advice related to their plan. Nearly three in 10 (29%) were either unaware of whether such advice was available or perceived that it was not available to them.

Perhaps most surprising is the fact that two out of three have said that they rarely, infrequently or never logged into the 401(k) provider’s recordkeeping website.

If you have any other questions, we’ve got answers. Get in contact with our 401(k) consultants today!