2023 Nonprofit Retirement Guide: 403(b) plans vs. 401(k) plans

Key takeaways:

- Tax-exempt, nonprofit organizations can offer a 401(k), a 403(b), or both.

- Recent regulatory changes are making nonprofit 401(k)s even more popular among many tax exempt organizations.

- 401(k) plans are often significantly cheaper for both employers and employees

- 401(k) plans provide greater flexibility with eligibility and features designed to drive high participation rates.

403(b) Overview

403(b)’s, also known as Tax-Sheltered Annuity (TSA) plans, are exclusively available to certain tax-exempt organizations (e.g., 501(c)(3)’s, schools, etc.) while 401(k)s can be used by any employer (private companies or nonprofits). While 403(b) plans were once the go-to option for non-profits, high 403(b) fees, limited 403(b) eligibility options and their dwindling administrative edge has led many nonprofits to switch to 401(k)s. The 2022 Secure Act 2.0 may accelerate this trend away from 403(b)’s as the best retirement plan for many nonprofits.

In this post we will discuss how new legislation is changing the comparisons of retirement plan options for nonprofits. We’ll compare the differences between 403(b)s and 401(k)s, covering the:

- Types of 403(b) plans

- Administrative duties of 403(b)s vs. 401(k)s

- Eligibility options of 403(b)s vs 401(k)s

- Why many employees prefer 401(k)s to 403(b)s

- Fees of 403(b)s vs. 401(k)s

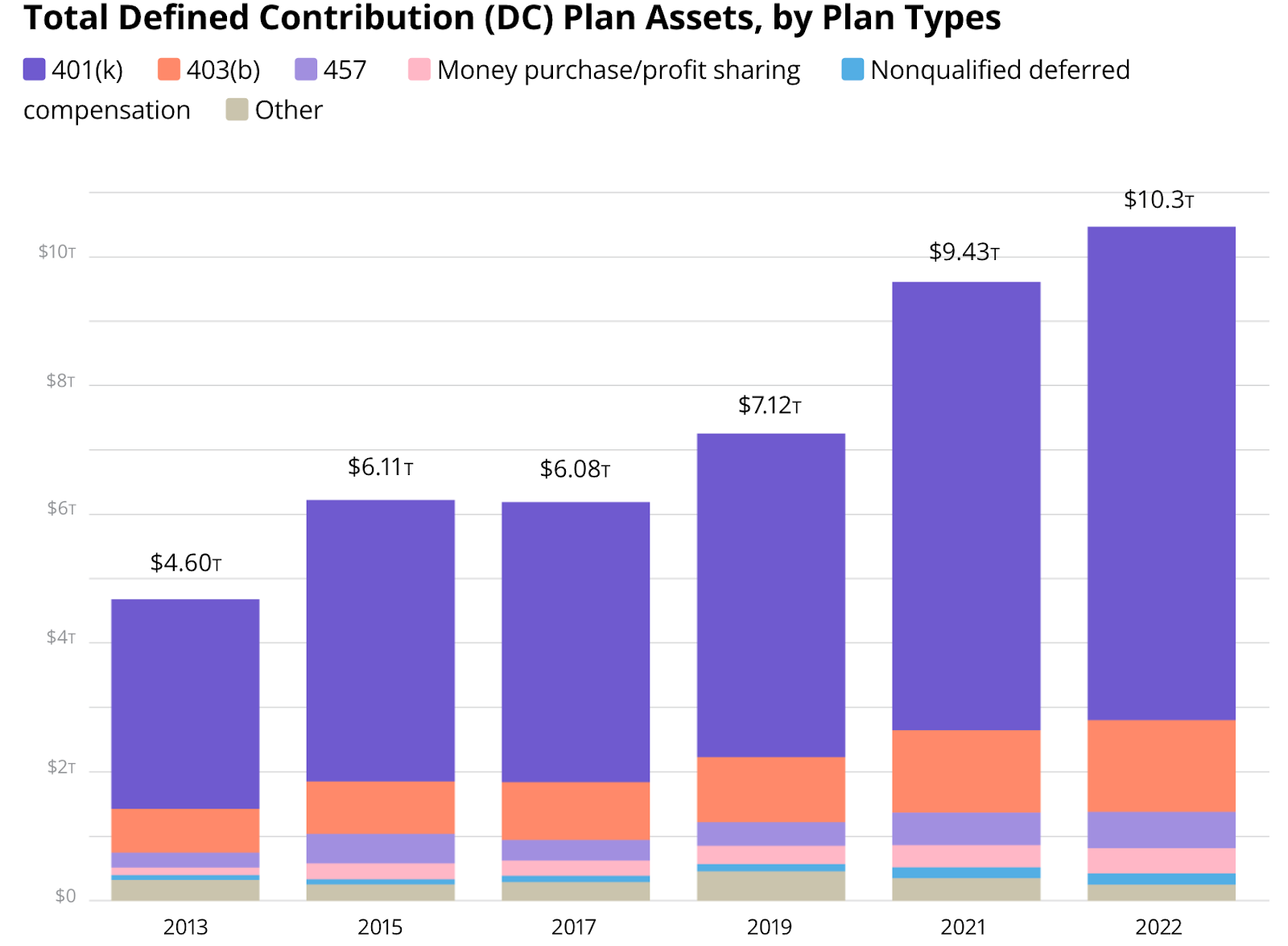

In 2022, total assets in 401(k)s continued to outpace the growth of 403(b)s ($1.4 trillion in 2022). A number of factors may contribute to this trend.

If you’re curious who some of the biggest names in the space are, check out our list of top 403(b) providers.

Which organizations are eligible for 403(b) plans?

Organizations that are allowed to offer a 403(b) plan include:

- Organizations that fall under the 501(c)(3) Internal Revenue Code

- Public School systems

- Cooperative hospital service organizations

- Civilian faculty and staff of the Uniformed Services University of the Health Sciences (USUHS)

- Public school systems organized by Indian tribal governments

- Certain ministers (empoyloyed by a 501(c)(3), self-employed, functioning as a minister in daily responsibilities with their employer, such as a hospital chaplain)

What is the difference between an ERISA and a non-ERISA 403(b) plan?

Unlike 401(k) plans, not every 403(b) plan must comply with ERISA regulations. In fact, non-ERISA plan assets accounted for 45% of all 403(b) assets, according to an April 2023 updated report from Brightscope and ICI.

Whether a 403(b) plan is an ERISA or non-ERISA plan depends on whether the employer makes a contribution to employee accounts and the extent of their involvement.

Non-ERISA 403(b) are often supplemental to other retirement plans offered by an employer (e.g., pensions, etc.) because Department of Labor Regulations place a number of constraints on employers that can decrease the number of employees that use the plan.

With Non-ERISA 403(b) plans, employers:

- Cannot provide a match (or other employer contribution) to employees; and

- Cannot adopt popular automatic enrollment or automatic escalation features

The benefit of having a Non-ERISA plan is reduced administrative and fiduciary responsibilities required under ERISA:

- May not need to file an annual form 5500

- May be exempt from annual large plan audit

- May be exempt from annual nondiscrimination tests

While avoiding ERISA requirements may seem great on the surface, lack of employee protections may be one of the reasons 403(b)’s have historically been more expensive than 401(k) plans. In fact, in 2022 AARP wrote:

“403(b)s lack many of the basic protections that 401(k) plans have accumulated over the years. And they are stuffed with expensive investments that may be costing participants as much as $10 billion a year in excess fees...

How are 403(b)s and 401(k)s the same?

Both 403(b)s and nonprofit 401(k) plans have the same annual contribution limits, which for 2024 are:

Moreover, both 403(b)s and 401(k)s support:

- Pretax, Roth or after-tax contributions

- Loans and Hardship withdrawals

- Roth employer contributions (new with 2023 Secure Act 2.0)

403(b) vs 401(k) plans: Which is better for nonprofits?

In the past, conventional wisdom held that 403(b) plans were easier to administer than 401(k)s, but often more expensive - especially when it came to investments. But the 2022 Secure Act 2.0, has changed the legal differences between 403(b)s and 401(k)s considerably. Under the new rules, administrative differences have narrowed, making 401(k) plans more popular with many non-profit organizations looking for a low cost retirement plan that is easy to administer. To understand the key differences - let’s start with a review of the types of 403(b) plans - ERISA vs. Non-ERISA.

401(k) vs. 403(b) - which is easier to administer?

From an administrative perspective, a non-ERISA plan is still generally easier to manage than a traditional 401(k) but comparable to a Safe Harbor 401(k).

Unlike traditional 401(k)s, non-ERISA plans aren't subject to an annual audit and sponsors don’t have to file IRS Form 5500. Moreover, non-ERISA plans are not subject to key ERISA fiduciary standards and are exempt from the annual nondiscrimination testing.

ERISA 403(b) plans, however, must still administer the ACP test (learn more about compliance testing here) and file an annual 5500, but are not subject to the annual ADP and top-heavy tests.

401(k) vs. 403(b)s - which has more flexibility? What is Universal Availability?

Compared to 401(k)s, 403(b) have significantly less flexibility when it comes to defining employee eligibility. Under Internal Revenue Code 403(b)(12)(A)(ii), most 403(b)s are subject to the “universal availability requirement” which restricts employers from customizing eligibility based on age or service, (though some church organizations are exempt).

Universal availability can significantly increase the cost of the plan - especially if the non-profit plans to provide a match. It can also significantly increase the chance of 403(b) administrative errors (it ranked #2 on the IRS’ list of top 10 403(b) plan failures).

For example, a 501(c)3 could choose to base eligibility on 3, 6 or even 12 months of service - if they had a 401(k), but not if they had a 403(b). Under the old rules, the primary way non-profits could limit eligibility was to exclude employees that worked fewer than 20 hours per week.

Universal availability, however, is changing with SecureAct 2.0, which soon requires employers to cover all employees that work at least 500 during three consecutive years. If universal availability was hard to administer under the old rules, it will likely become more challenging after Secure Act 2.0.

Pros and Cons of 403(b)’s vs. 401(k)’s

While easier year-end testing is indeed a benefit of non-ERISA 401(k)s, Safe Harbor 401(k)s offer employers similar ease with more flexible eligibility options which can significantly cut employer costs.

How to lower costs by switching to a Safe Harbor 401(k)

While Safe Harbor Plans require employers to provide a minimum contribution of at least 3.5%, the April 2023 update to the ICI/Brightscope 403(b) report found that nearly 40% of 403(b)’s would likely be able to switch to a Safe Harbor plan without significantly increasing their 401(k) contributions.

Many non-profits can even lower employer contribution costs by switching to a 403(b) if they introduce service or age-based eligibility requirements!

Do nonprofit employees prefer a 401(k) to a 403(b)?

Employees are significantly more likely to use a 401(k) compared to a 403(b), suggesting that employees strongly prefer a 401(k) to a 403(b).

According to a 2022 report from the Plan Sponsor Council of America (PSCA), only 79.4% of employees participated in their employer’s 403(b) plan, significantly less than 401(k) participation rates of 89.4%. PSCA’s 2022 reports also found that 403(b) participants saved considerably less - with an average savings rate of 6.9% vs. 8.3% for 401(k) participants. Taking into account both the higher savings and participation rates it appears that employees save nearly 40% more in a 401(k) vs. a 403(b).

High 403(b) fees

While the prevalence of pension plans in many public sector employers may explain some of the gap, the perception of high fees may also play a crucial role. Indeed, in 2022 Plan Sponsor wrote:

“Despite there being a lot of good providers out there, there’s this assumption that many are high fee, low value…”

AARP was even more critical in 2022, writing:

The disturbing truth is that the retirement plans offered to more than 8 million public-school employees and many more nonprofit workers typically fall short of their private-sector counterparts.

Even the IRS noted the risks of high fees and advised that 403(b) “may have high administrative costs” as one of the primary “cons” of 403(b) plans.

Interestingly, 403(b) plan sponsors appear to be behind the curve on general perceptions as only 5.1% indicated that lowering plan costs was a key priority for 2022, according to PSCA.

The Match Matters

According to a recent article from Money,

74% would be likely to leave their job for another company that offered better financial benefits, and the top two most enticing benefits are — again — a high-quality 401(k) or other retirement plan and a 401(k) matching program.

Unfortunately, non-ERISA 403(b)s cannot provide a company match (or other company contribution) to their employees.

Employees value automatic savings

A recent Principal Survey, found that:

84% of workers who have been automatically enrolled into their workplace retirement plan say they are glad that their savings has been jump-started.

Unfortunately, non-ERISA 403(b)s do not allow employers to leverage automatic savings programs like automatic enrollment with automatic savings escalations.

Are 403(b)s more expensive than 401(k)s?

While 403(b) plan fees have generally decreased over the past few years, they still have a fair amount to fall. In fact, ICI’s April 2023 update found that the smallest 403(b)’s paid more than 1.08% in total plan fees on average while an unlucky 10% paid more than 2.3% in total plan fees.

Are 403(b) investment fees higher than 401(k)s?

ICI’s 2023 report also showed that 403(b) Investment fees have room for improvement. Here the smallest plans paid average fees of 0.60% and 0.78% for domestic and international stock funds, respectively. Low-cost index funds in 401(k) plans from Fidelity and Vanguard, however, generally range from 0.3% to 0.8% - nearly 10x cheaper.

What kind of investments are offered in a 403(b) plan?

403(b) plans are also referred to as “tax sheltered annuity plans,” and not surprisingly, they include annuities in their investment menu (often alongside traditional mutual funds). These generally come in two forms: variable annuities and fixed annuities.

While the inclusion of annuities may sound great, ICI’s April 2023 403(b) update update suggest that employees preferred mutual funds over annuities by nearly 2 to 1:

2023 403(b) fee litigation

One area where 403(b) plan sponsors seem to have a different view from 401(k) sponsors is their willingness to use their recordkeeper’s proprietary investment products. While 401(k) sponsors are increasingly embracing open-architecture platforms that allow employers to go beyond the proprietary offerings of the recordkeeper, many 403(b) plan providers load up the plans with expensive, proprietary investment products.

Indeed, University of California settled a $13M lawsuit in 2023 related to excessive fees associated withtheir 403(b) plan.

Which retirement plan is best for your nonprofit?

If you have a 403(b) and are looking to make employer contributions, you may want to consider who will handle the increased administrative load of an ERISA plan. Or if you are wanting to customize employee eligibility, then a 401(k) plan might be the right option for your 501(c)3.

Note: The information contained in this post is not intended to be or relied on as legal advice. You should consult an ERISA attorney or another professional plan consultant before making any decisions or changes.