The Complete Guide to 401(k) Corrective Distributions

Hotel Pacifica has problems with their 401(k).

At the end of every year, Red Jensen, Hotel Pacifica’s Director of HR, takes what he likes to call his “annual 401(k) beating.” Several highly compensated employees (HCEs) – including top executives – storm into his office to receive their corrective distributions – checks returning significant amounts of their 401(k) contributions.

Red then has the displeasure of telling his HCEs that these corrective distributions are fully taxable. Rather than making tax-deferred contributions to their retirement plan, Red’s HCEs receive unexpected taxable income that may push them into a higher tax bracket.

As you can imagine, no one’s happy about this. For good reason, too.

Making corrective distributions is an administrative burden, can lead to fines and excise taxes if not done promptly, and, perhaps most notably, frustrates HCEs, who are a very expensive and difficult group of employees to replace.

If you find yourself needing to make corrective distributions, don’t worry. This is a very common problem, and there are solutions. That’s why we put together this guide – to walk you through everything you need to know about corrective distributions. We’ll discuss how to make them, important deadlines, how to avoid needing to make them, and other tips that’ll save you time and frustration. Let’s get started!

Looking for specific information about corrective distributions? Skip straight to the information you need.

- Understanding Nondiscrimination Testing: Why Corrective Distributions are Necessary

- How to Make Corrective Distributions

- Corrective Distribution Deadlines and Penalties

- Fixing a Failed Nondiscrimination Test Without Corrective Distributions

- Safe Harbor: Avoid Corrective Distributions with This Plan Design

- Affordable Ways to Avoid Making Corrective Distributions

Understanding Nondiscrimination Testing: Why Corrective Distributions are Necessary

Every year, the IRS requires plan administrators to run tests (non-discrimination tests) to ensure that the benefits from a company’s 401(k) plan are broadly shared. The IRS wants to make sure the 401(k) doesn’t disproportionately favor Highly Compensated Employees (HCEs), who are employees that fall into one of two categories:

- Individuals that own more than 5% of the employer in the testing year or the year before. Stock attribution rules apply, where any company stock owned by spouses, parents, grandparents, or children is also considered to be owned the individual.

- Employees who received compensation above the limits specified by the IRS for the previous year ($120,000 for 2017 and 2018). Alternatively, employers can define this group as the top 20% of employees based on compensation provided this is allowed in the plan document.

All other employees are considered non-highly compensated employees (NHCEs).

Corrective distributions are made to fix a plan that’s failed one of two nondiscrimination tests: the actual deferral percentage (ADP) test or the actual contribution percentage (ACP) test. Both are very similar tests calculated with slightly different information. We’ll start with the ADP test.

Actual Deferral Percentage (ADP) Test

The ADP test compares the average 401(k) deferral rates of HCEs to NHCEs for the plan year in question. Deferral rates are calculated by dividing the employee’s total 401(k) deferral for the year by their total compensation (as defined in the plan document).

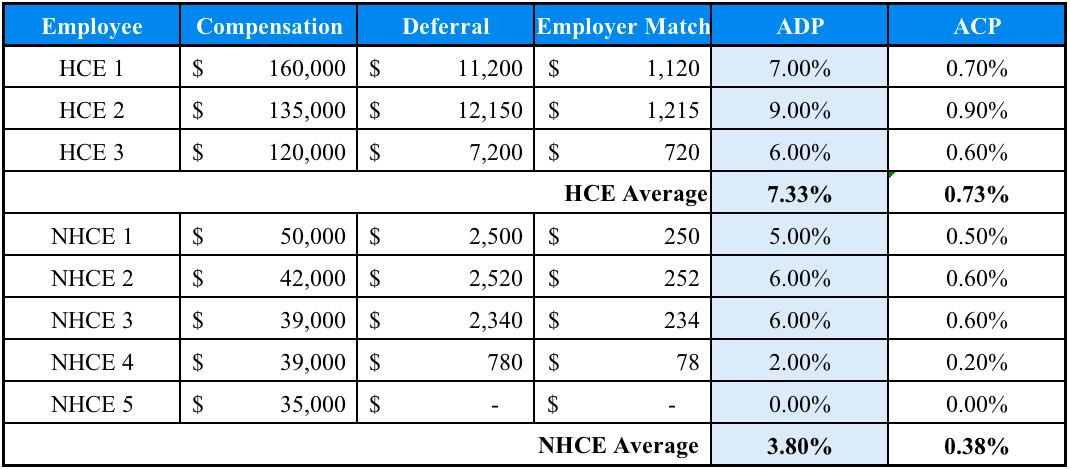

Here’s an example of what ADP determination looks like:

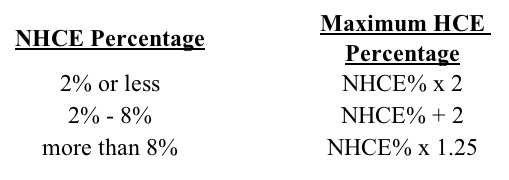

To pass the test, the average deferral rate for HCEs may only exceed the NHCEs by specific limits summarized below:

With an average NHCE ADP of 3.80%, the maximum allowed HCE ADP is 5.80%. With an HCE ADP of 7.33%, the plan in this example fails the test.

Actual Contribution Percentage (ACP) Test

This test is exactly the same as the ADP test aside from one detail. Instead of looking at deferral rates, the ACP test compares the average contribution percentage of HCEs to NHCEs, which is calculated by dividing the employee’s total contributions (employer match plus any after-tax contributions the employee made) by their total compensation for the year.

Here’s what our example from above looks like when including ACP determination:

To pass the ACP tests, the HCE group contribution percentage may only exceed the NHCE group percentage by the same limits as in the ADP test.

With an average NHCE ACP of 0.38%, the maximum HCE ACP is 0.76%. With an ACP of 0.73%, this plan passes its ACP test, even though it failed its ADP test.

If your plan fails either of these tests, corrective distributions must be made to HCEs until the group’s actual deferral percentage or actual contribution percentage falls within the allowed threshold.

How to Make Corrective Distributions

If your plan fails its nondiscrimination testing, don’t panic. Calculating the corrective distributions each employee will receive until the plan passes the ADP and/or ACP tests might be a bit confusing, but we’ve broken it down into 3 simple steps so you can quickly get your plan back on track.

Step 1: Calculate the Total Corrective Distribution for HCEs

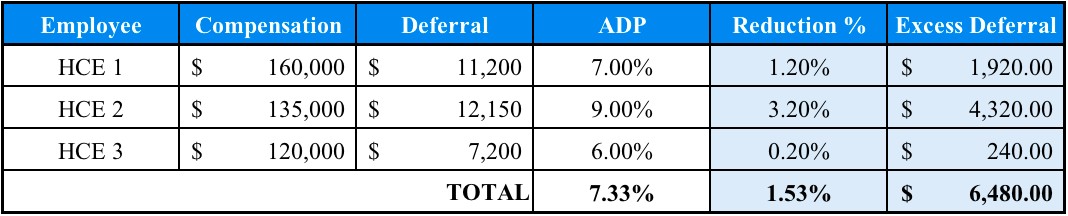

To determine how much must be returned to each HCE, we have to first determine how much must be returned to the group as a whole until the plan passes the ADP and/or ACP test. Here’s the simplest way to do this:

- Calculate each HCE’s reduction percentage: calculate each HCE’s excess percentage: this is the difference between each HCE’s actual deferral (or contribution) percentage and the maximum allowed percentage.

- Calculate the Total Excess Deferral: multiply the total compensation for each HCE by their reduction percentage. The total of these numbers is the total amount that must be returned to the HCEs to put the plan back into compliance.

Note: we’re only calculating the Total Excess Deferral amount here – not the corrective distribution that can be made to each HCE. The Total Excess Deferral must be allocated a little differently. We’ll talk about that next.

Step 2: Calculate Each Individual HCE’s Excess Deferral

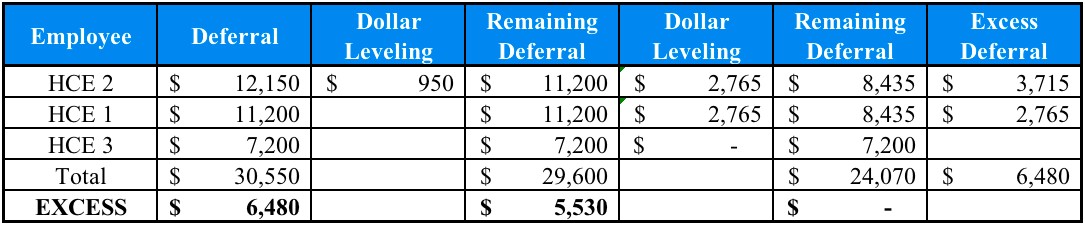

Once you know the total corrective distribution, the next step is to figure out how to fairly distribute it among your HCEs. This is done using what’s called the Dollar Leveling Method.

To do this, we have to calculate the Excess Deferral (or Contribution) Amount for each HCE in descending order until the Total Excess Deferral Amount is completely exhausted.

Start by sorting your list of HCEs from highest to lowest by their Total Deferral (or Contribution) Amount for the year in question. Now, starting with the HCE at the top of the list, subtract the next highest HCE’s Total Deferral Amount from the top HCE’s Total Deferral Amount. This gives you the top HCE’s Excess Deferral Amount.

Repeat this process for each HCE on the list in descending order until the Total Excess Deferral (or Contribution) Amount is completely exhausted.

If an HCE’s Excess Deferral Amount would be greater than the remaining Total Excess Deferral Amount, then the remaining Total Excess Deferral Amount is distributed evenly between that HCE and the HCE immediately below them.

Using our example ADP correction, this process should look something like this:

Okay, take a breath. This step might’ve been a doozy, but thankfully we’re almost done!

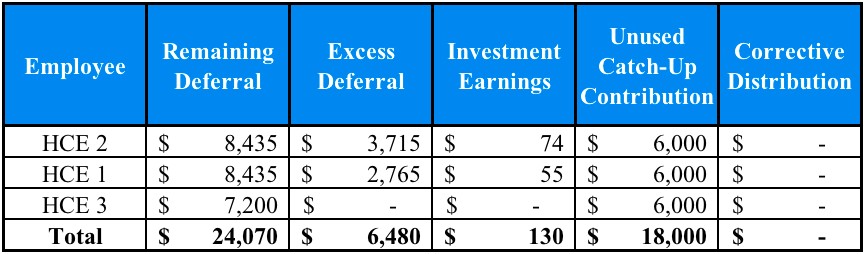

Step 3: Calculate Each HCE’s Corrective Distribution

For employees under 50, their corrective distribution is equal to their Excess Deferral plus their estimated Investment Earnings – whatever amount of money their Excess Deferral earned while it was invested. There’s a lot of different ways to estimate this. Whichever way you do it, be sure to document it and be prepared to back it up to the IRS.

For those that are 50 or over, there’s just one additional step required.

The IRS allows employees 50 and over to make additional salary deferrals up to a certain limit ($6,000 in 2018) to their 401(k) beyond the yearly deferral limit of $18,500. These “catch-up contributions” are not counted against the plan in either the ADP or ACP test.

So for each HCEs 50 and over, we can use any unused catch-up contribution allowance to offset their Excess Deferral. For the sake of simplicity, we’ll say none of the HCEs in our example have used any of their catch-up contribution allowance.

As you can see, in this example, recharacterizing the Excess Deferrals as catch-up contributions completely eliminates the need to issue corrective distributions. It won’t always work out this way, but accounting for unused catch-up contributions can often take a sizable chunk out of your HCEs’ Excess Deferrals.

And there you have it! If done correctly, making these corrective distributions to your HCEs should put your plan back into compliance.

Corrective Distribution Deadlines and Penalties

If your plan fails nondiscrimination testing, there are a couple of important deadlines by which corrective distributions must be made to avoid penalties.

Corrective Distribution Deadlines and Penalties****Deadline****Penalty**2 ½ months after plan year endYour company has to pay a 10% excise tax on the Total Excess Deferral (or Contribution).12 months after plan year endmay put the plan’s tax-qualified status in jeopardy. Plans that miss this deadline must make an immediately vested employer contribution to all NHCEs equal to the HCEs’ Total Excess Deferral using what’s called the “one-to-one method.

Fixing a Failed Nondiscrimination Test Without Corrective Distributions

In our experience, there are two primary ways failed nondiscrimination tests can receive a passing grade without the need to make corrective distributions.

Alternative Fix #1: Applying Disaggregation

Disaggregation is a little-known process that can actually completely change the results of a nondiscrimination test. Here’s how it works.

Employers can split their employees into two groups: those that meet the IRS maximum eligibility requirements (21 years of age with 12 months & 1,000 hours worked) and those that don’t. Then, they can run separate ADP or ACP tests with each group.

The advantage of doing this is simple. Employees that don’t meet the IRS maximum requirements are generally young, low-paid, part-time employees that are unlikely to participate in the 401(k), and if they do, probably won’t defer very much. If these employees could be somehow removed from the test, that would significantly increase the plan’s chances of passing. Here’s where the trick comes in.

Employees who don’t meet the IRS maximum eligibility requirements are almost never HCEs. And without any HCEs in the group, the group automatically passes its ADP or ACP test, effectively removing it from the test.

If you find your plan running into nondiscrimination trouble, always be sure to ask if the provider performing the test has applied disaggregation.

Alternative Fix 2: QNECs and QMACs

Making corrective distributions is not the only way to remedy a failed nondiscrimination test. Rather than returning money to HCEs, plan sponsors can instead opt to make special contributions to NHCEs’ 401(k) accounts until the plan gets passing scores on its ADP and/or ACP tests. There are two types of contributions plan sponsors can make:

- Qualified Non-Elective Contributions (QNECs): these are non-elective contributions of up to 5% of the employee’s total compensation for the plan year. These are made to all eligible employees, regardless of how much they deferred. These are normally made to correct an ADP test failure.

- Qualified Matching Contributions (QMACs): these contributions are made as a percentage of the employee’s elective deferral. Typically, these are used to correct an ACP test failure.

Both types of contributions are required to be 100% vested immediately, and are subject to certain distribution restrictions. Both QNECs and QMACs can be used to fix either ADP or ACP tests, however you can’t use one of them to fix both ADP and ACP tests at the same time – you must apply the contribution to one or the other. If you need to correct both tests, you’ll need to apply a QNEC to one test and a QMAC to the other.

Not only are there a lot of rules with QNECs and QMACs, but they can also be quite expensive. Wouldn’t it be great if there were easy ways to avoid failed nondiscrimination tests altogether?

Luckily, there are!

Safe Harbor: Avoid Corrective Distributions with This Plan Design

Safe Harbor is a 401(k) plan design that automatically exempts a plan from ADP, ACP, and Top-Heavy Testing. In order to be considered a Safe Harbor 401(k) by the IRS, a plan is required to make one of three employer contributions to each eligible employee:

- Basic Match: a 100% match to all employee deferrals up to 3% of their compensation, and then a 50% match on the next 2% of their compensation.

- Enhanced Match: a 100% match (or more) to all employee deferrals on at least 4% (6% max) of their compensation.

- QACA Safe Harbor Match: a 100% match on the first 1% of the employee’s compensation, and then a 50% match on the next 5% of their compensation.

- Non-elective Contribution: an employer contribution of at least 3% made to all eligible employees, regardless of how much they deferred.

Safe Harbor plans are a great way to avoid nondiscrimination testing, and to help your employees prepare for retirement. The biggest downside? They’re expensive. Luckily, there are a few more affordable alternatives.

Affordable Ways to Avoid Making Corrective Distributions

Not every company is in a financial position to offer safe harbor contributions. Luckily, there are a few affordable ways to avoid needing to make corrective distributions.

Use the Prior Year Testing Method

Distinct from the current year testing method, the prior year method allows the plan administrator to compare the NHCEs’ deferral, contribution, and compensation amounts from the prior year to the HCEs’ amounts from the current year.

The advantage of doing this is that you know in advance the maximum ADP or ACP that the HCEs can have in the current year without putting the plan out of compliance. You can alert HCEs of the cap on their deferrals and contributions at the beginning of the year, which, theoretically, should make you less likely to fail your nondiscrimination testing.

This isn’t ideal as HCEs are still limited in how much they can contribute. But hey, better than being surprised, right?

Improve Your Plan’s Employee Experience

By making some improvements to your existing 401(k), you can pass non-discrimination testing without resorting to safe harbor. Doing this comes down to two strategies:

- Improve employee participation: since ADP and ACP tests look at the deferral/contribution rates of ALL eligible employees, a low participation rate can wreak havoc on your test results. Non-participating employees (usually NHCEs) have a deferral rate of 0%, which brings down their group’s average.

- Improve employee deferral rates: boosting participation rates alone isn’t enough. Getting your NHCEs to defer more of their paychecks means a higher possible ADP for the NHCE group.

Of course, both of these strategies are easier said than done. NHCEs are the hardest group of employees to engage with the 401(k). They make less money, are more likely to be stressed about their finances, and may not even understand how 401(k)s work.

Whatever their reasons for not saving, most would probably agree that saving for retirement is important. The problem is, typical 401(k)s require employees to wade through confusing stacks of paperwork just to enroll. Then they have to make expert-level investment decisions, oftentimes without receiving much in the way of guidance or support. Is it any wonder that many NHCEs don’t enroll?

Luckily, this is a fixable problem too.

Implementing automatic enrollment and escalation is one very effective step. Another option might be to change the structure of your employer match (if you offer one) to incentivize greater participation and deferral rates.

If you’d like to learn about some others, check out our short post!

Conclusion

Everyone agrees – corrective distributions are a pain. Your HCEs have to pay more income tax, your plan administrator has to spend time crunching numbers, and employee retention among your HCEs may suffer. However you look at it, there’s a real cost to making corrective distributions.

If you have to make them, be sure to make them correctly and on-time. And for the sake of your sanity, implement whatever changes you need to avoid having to make them year after year. You could save your company a lot of time, hassle, and money.

Most importantly? Your life will be just that much easier. And isn’t that what’s important?

How much are corrective distributions costing your company?