Safe Harbor Match Options [Getting Started in 2024]

![Safe Harbor Match Options [Getting Started in 2024]](https://assets-global.website-files.com/63debbf370afa6e136a8aff0/65fb4bcc5254881ea7f85b58_647922b11e7eddf58fcb58b5_241.png)

Adding a Safe Harbor match allows employers to automatically pass stringent year-end nondiscrimination tests mandated by the IRS. To create a Safe Harbor 401(k), employers generally commit to providing a company 401(k) contribution between 3% to 6% of employee, which typically vests immediately.

In a 2023 study, 35% of small businesses chose a Safe Harbor plan and in 2022 nearly 70% of companies that made employer contribution chose a Safe Harbor 401(k) plan design.

The success and cost of a Safe Harbor 401(k) depend heavily on four key decisions: the contribution formula, eligibility, vesting and auto-enrollment.

In this article, we’ll dive into the range of Safe Harbor Match options, alternatives to the traditional Safe Harbor Match, and how to choose the Safe Harbor design that best fits your goals. We’ll also discuss four key strategies you can use to decrease Safe Harbor costs and improve the chance your plan achieves strategic company goals.

Overview: Safe Harbor 401(k) Plans

The Safe Harbor 401(k) plan is an innovative approach that allows employers to bypass the daunting IRS nondiscrimination testing. In exchange, employers must commit to a minimum contribution of 3% of employee pay and agree to vest these contributions immediately.

Despite these constraints, Safe Harbor 401(k)s are incredibly popular because they are often easier for employers to administer. In its essence, Safe Harbor plans provide employers the opportunity to make contributions to their employees' retirement savings without undergoing the stringent tests typically associated with traditional 401(k) plans.

The IRS advocates for fairness and equity across all employee categories in a 401(k) plan. The Safe Harbor 401(k) allows companies to achieve this balance without the need for complex administrative tasks.

The Appeal of Safe Harbor 401(k)s

Unlike traditional 401(k) plans, Safe Harbor plans automatically pass three key annual IRS-mandated nondiscrimination tests, explained in detail below. This allows employers to maintain a balanced 401(k) plan without facing the potential complexities and penalties of traditional 401(k) plans. The complexities and risks are real...

A 2023 study found that 32% of companies faced challenges with passing nondiscrimination tests, even when they adopted automatic enrollment.

Safe Harbor plans help ensure employees reap the benefits of tax-advantaged retirement savings and help enable executives to max out their personal contributions to the new 2024 contribution limits ($69,0000 or $76,500 for employees 50+).

2024 Safe Harbor Match Options

Selecting the right Safe Harbor contribution option is one of the most effective ways to control plan costs and help you meet your goals. A recent 2022 Study found that 70% of companies that provided an employer contribution chose a Safe Harbor plan with roughly half choosing a Safe Harbor match with the remainder choosing a Safe Harbor non-elective contribution. But there are far more than just two choices, To be a Safe Harbor plan, small businesses may choose between six types of Safe Harbor contributions:

1. Traditional 4% Safe Harbor match

Employers must match 100% on employee salary deferrals up to 3% of their compensation, and then 50% match on the next 2% of their compensation. Moreover, employers must agree to vest all company contributions immediately, meaning an employee can leave the day after they receive their match and take 100% of the match.

2. Safe Harbor 3% non-elective contribution

An employer contributes at least 3% of eligible plan compensation to all eligible employees, regardless of how much they defer. Like the Traditional Safe Harbor Match, these contributions also must vest immediately.

3. Safe Harbor enhanced match:

Employers can be more generous by creating their own match formula that is at least as generous as the traditional 4% match at each tier. However, the enhanced Safe Harbor match cannot:

- Require employees to contribute more than 6% of their pay to get the full match; or

- Cannot escalate based on the amount employees save

For example, employers can create a match formula that:

- Matches 100% on the first 4%, 5%, or 6% of compensation.

- Match 200% on the first 1% and then 100% on the next 3%

But employers cannot offer a 100% match on the first 7% of pay saved (violates 6% cap) or match 100% on the first 4% and then 150% on the next 2% (violates escalating match). Moreover, all contributions must vest immediately.

4. Enhanced Safe Harbor non-elective

Similar to the Enhanced Safe Harbor Match, the enhanced non-elective allows employers to provide a contribution in excess of the minimum traditional Safe Harbor nonelective (3%). However, just like the traditional Safe Harbor all employer contributions must be immediately vested.

5. QACA Safe Harbor match

The QACA Safe Harbor match differs significantly from the Traditional and Enhanced Safe Harbor in three respects:

- A lower minimum required match (3.5% with QACA Match vs. 4% with a Traditional Safe Harbor Match)

- The option to vest contributions

- Requirement that you adopt automatic enrollment.

The QACA match formula is also a bit different - at minimum you must provide a 100% matching contribution on the first 1% of the employee’s compensation, and then a 50% match on the next 5% of their compensation. Importantly, employers can add a 2-year cliff vesting schedule to any contributions they make. However, they must also automatically enroll participants at a minimum of 3% (and no more than 15%). Additionally, employers must also add automatic 1% escalations until employees are saving 15%.

6. QACA Safe Harbor non-elective contribution

Similar to a Safe Harbor QACA match plan, however, employers must contribute 3% of eligible employee pay, regardless of whether the employee contributes. Employers must also adopt automatic enrollment but may add a vesting schedule of up to 2 years.

Which Safe Harbor contribution option is the cheapest?

Given the variety of Safe Harbor match and nonelective options, employers often have difficulty deciding which Safe Harbor Plan Design is best for them. In this section, we'll discuss the key factors driving cost, and top strategies that help minimize costs while maximizing benefits for owners and key executives.

The key factors that drive which option will be the most expensive are:

- Compensation: how much you pay eligible employees?

- Savings rates: what percent of pay do employees save?

- Participation rate: how many eligible employees are participating?

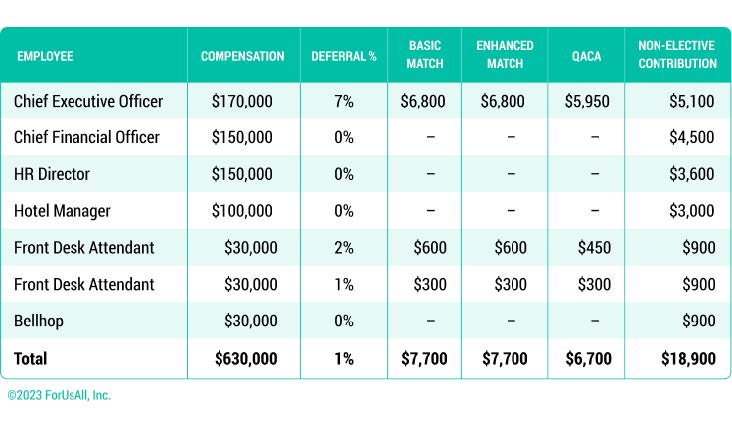

Let’s assume a fictional hotel with 7 employees (4 of which are managers for some reason), here’s how each of the Safe Harbor formulas would play out:

In this case, the QACA match turns out to be the most cost-effective. Not only does it have the lowest total company contribution, but those contributions can be vested up to 2 years. Any unvested balances can be used to offset plan fees or even pay for future year contributions.

Of course, these numbers can play out very differently for your business.

Use this calculator to estimate different costs for you.

Which Safe Harbor is best for business owners and executives?

Safe Harbor plans are also a powerful tool used by many business owners to maximize their personal tax savings.

In 2024, business owners can combine a Safe Harbor plan with a New Comparability Profit Sharing Plan to save up to $69,000 (under age 50) or $76,500 (age 50+).

However, in order for owners to max out their own profit-sharing contribution, they likely have to also make additional profit-sharing contributions to non-highly compensated employees (NHCEs).

This is where the 3% non-elective contribution comes in. Unlike the Safe Harbor match, the 3% non-elective can significantly reduce profit sharing due to NHCEs. For this reason, the 3% non-elective is one of the most popular Safe Harbor options for savvy business owners looking to shelter more of their hard earned income from taxes.

Four Strategies to limit Safe Harbor Costs

Mandatory Safe Harbor contributions can get expensive, fast. Luckily, there are a number of strategies you can employe to help ensure that the Safe Harbor contributions stay within your budget.

Strategy 1: Customize eligibility to limit cost

Safe Harbor employer contribution can get expensive – fast. That’s why many employers are thoughtful in choosing employee eligibility – which can significantly reduce the cost of the plan (particularly for high-turnover populations).

Common Safe Harbor eligibility include:

- Immediate: Employees can join the plan and are eligible for the match the first day they join the company.

- 1-month: Employees must wait 1 month after their start date

- 3-months: Employees must wait 3 months after their start date

- 1-year: Employees must wait 12 months from their start date

For companies that are growing rapidly, or that have high turnover, using 1-year eligibility can significantly cut down on the Safe Harbor employer cost.

You can exclude highly compensated employees

While all eligible non-highly compensated employees must be eligible for Safe Harbor contributions, employers can choose to exclude highly compensated employees from Safe Harbor contributions. This can be a great way for an owner who is primarily looking to maximize their own personal tax savings, while limiting the cost of the plan overall.

Important 2024 eligibility update

In years past, many employers used the one-year and 1,000 hours requirement, but, in 2024 this is becoming less popular. Accurate hours data is often challenging to generate each pay period, and many companies had compliance issues. Additionally, under the new 2022 Secure Act 2.0, part-time employees will be eligible to participate in the plan if they have two consecutive years of service of 500 hours.

Strategy 2: Optimize your formula based on expected participation

The annual cost of your Safe Harbor contributions can be greatly impacted by the level of participation you expect from your team. For example, if you have a lot of employees who aren’t participating or deferring very much, the 3% non-elective contribution can be more costly than the matching options. Alternatively, if you expect more than 75% of employees to get the full match, then a 3% non-elective is likely to be cheaper than the 4% match.

Strategy 3: Save with QACA Vesting

On first glance, QACA plans often seem like they are going to be more expensive than traditional plans because they require automatic eligibility. With higher participation, more employees will receive the match, likely offseting any savings from the lower QACA match requirement (3.5% of eligible pay). That said, QACA plans have one significant advantage - you can add vesting of up to 2 years. Since any unvested contributions can be used to fund the company contribution in future years, companies with high turnover, are likely to see significantly lower match expenses in years 2 and beyond.

Strategy 4: Maximize Secure Act 2.0 Tax Credits

The 2022 SECURE Act 2.0 has made Safe Harbor plans even more attractive for small businesses by introducing new provisions, such as expanded tax credits and increased flexibility in plan design. The tax credits fall into two groups: Startup costs and contributions:

Startup cost tax credit:

The secure act may cover up to 100% of employer costs for a new 401(k) for the first three years ($250k per NHCE) for employers with fewer than 50 employees. Employers with more than 50 employees also receive the $250 per NHCE, however, their credit is limited to 50% of qualified employer costs. You can estimate your potential Secure Act tax credits here.

Employer contribution tax credit:

Employers may also be eligible for an additional $1,000 tax credit per employee for contributions to the employee's account. However, this tax credit only applies to contributions to employees that make less than $100,000 in 2023 (indexed for inflation). Additionally, this tax credit decreases each year as follows:

- Year 1: 100%

- Year 2: 100%

- Year 3: 75%

- Year 4: 50%

- Year 5: 25%

- Year 6+: 0%

Guidelines for choosing the right Safe Harbor Contribution Formula

When choosing the right Safe Harbor formula, there are a number of factors to consider that go beyond costs. Is the owner looking to maximize tax savings with additional profit sharing? Is the company primarily focused on attracting and retaining employees, or do you want to offer the lowest cost plan while automatically passing non-discrimination tests? This table will give you a good start in narrowing down your options based on your business objectives.

When do I need to make the Safe Harbor contribution?

Employers offering a Safe Harbor match or non-elective either at the end of the year or on an ongoing basis. However, if you fund the Safe Harbor contribution at the end of the year, you must fund the contribution before you file your taxes to claim as a business deduction. Many employers prefer to fund the match with each payroll because it allows them to spread the cost over the entire year. Employees often prefer ongoing funding because they are able to invest this money sooner - providing additional potential compounding.

Automatically pass nondiscrimination tests with Safe Harbor Contributions

The three annual nondiscrimination tests set by the IRS—ADP (Actual Deferral Percentage), ACP (Actual Contribution Percentage), and the Top-Heavy test—aim to maintain a balanced contribution field between the Highly Compensated Employees (HCEs), Key Employees and everyone else. To pass these tests employees across the company simply need to join and save at similar rates.

New 2024 Limits For Key Employees and Highly Compensated Employees

The IRS changes income limits for Key Employees and HCEs periodically, and in 2024, income limits for Officers and highly compensated non-owners increased by $15,000.

Here's what each test entails:

The ADP Test

The ADP test primarily focuses on the percentage of compensation HCEs can defer into their 401(k). It calculates the average savings rates (ADP) of NHCEs to HCEs—defined as those earning over $150,000 or owning more than 5% of the busines. The ADP for both groups needs to be within approximately 2%.

Small businesses with low participation rates are most often affected by this test. If you fail the ADP test you may need to either return money to HCE’s (to bring down their average) or contribute to NHCE accounts with a QNEC (to bring up their average). However, returning money to HCE’s will likely trigg cause taxation on the returned amounts, potentially reducing the benefits of pre-tax contributions.

The ACP Test

Similar to the ADP test, the ACP test scrutinizes the employer contributions, ensuring that the employer match isn't disproportionately high for HCEs compared to NHCEs. The acceptable average contribution ratio (ACP) of HCEs to NHCEs also needs to be within approximately 2%.

A failed ACP test can be remedied in the same way as a failed ADP test, by adjusting contributions to create a fair balance.

The Top-Heavy Test

The Top-Heavy test's objective is to ensure that key employees hold less than 60% of the total plan balance. The IRS may require companies failing the Top-Heavy test to make up to a 3% contribution to non-key employees to maintain non-discriminatory practices.

The Consequences of Non-Compliance

In a worst-case scenario, non-compliance with these tests could lead the IRS to impose a 10% penalty on excess contributions, or even disqualify the 401(k) savings plan, which can have significant consequences. The latter case could trigger taxes for the employees, employer, and the Plan’s trust.

Yet, there is a silver lining. Most businesses pass these tests, although approximately half of them may need to refund money to employees or restrict plan contributions to meet the requirements.

Safeguarding Small Businesses and Boosting Participation

Businesses, particularly small enterprises with lower participation rates, stand to benefit significantly from Safe Harbor 401(k) plans.

Increasing the overall participation rates by all employees also reinforces the strength of the plan, leading to higher savings and, ultimately, a more financially secure future for all participants.

Empowering Highly Compensated Employees

Another key advantage of the Safe Harbor 401(k) plan is the freedom it provides for Highly Compensated Employees. The restrictions imposed by traditional 401(k) plans can often limit the amount that HCEs can contribute, thereby inhibiting the growth of their retirement savings.

With Safe Harbor plans, HCEs are enabled to contribute the maximum allowable amount to their 401(k) each year, enhancing their retirement savings potential.

Attracting and Retaining Quality Employees

A comprehensive and fair 401(k) plan can serve as an attractive incentive for potential employees. The Safe Harbor plan, with its commitment to fairness and maximized contributions, can often be a key deciding factor for top-tier talent considering joining your company.

Moreover, the security of a well-managed retirement plan helps retain your existing employees, reducing turnover and promoting a stable, committed workforce.

Adopting the 401(k) Safe Harbor Match: An Employer's Perspective

The process of adopting a Safe Harbor 401(k) plan involves several strategic decisions, each of which must align with both the employer's business goals and the financial welfare of their employees.

Annually Reviewing the Plan

Annual reviews of the Safe Harbor plan ensure it continues to meet the requirements set by the IRS, as well as addressing the changing needs of the business and its employees.

Delivering a Safe Harbor Notice

Employers must deliver a Safe Harbor notice to all eligible employees at least 30 days before the beginning of the plan year. This notice should outline the employer's contributions, any optional employee contributions, withdrawal restrictions, and other pertinent information.

Conclusion

The 401(k) Safe Harbor Match presents a compelling solution for businesses aiming to offer a balanced, robust, and enticing retirement savings plan for their employees. By reducing administrative complexity and fostering a fair and inclusive financial landscape, the Safe Harbor plan empowers both employers and employees to secure a prosperous future.

Navigating the intricacies of 401(k) Safe Harbor plans can be challenging, but with the right information and strategic decisions, it can be a valuable tool in the financial arsenal of any business.