Safe Harbor 401(k): 2024 Guide For Employers

Navigating the world of retirement plans can be overwhelming, especially when deciding between traditional 401(k) plans and safe harbor 401(k) plans. In this blog post, we'll discuss the benefits of safe harbor 401(k) plans for business owners, how they compare to traditional 401(k) plans, and answer some frequently asked questions about safe harbor plans.

What is a Safe Harbor 401(k) Plan?

A safe harbor plan is a type of 401(k) that ensures all eligible employees receive a company contribution (like a company match). Unlike a traditional 401(k), a safe harbor plan doesn’t require business owners to perform annual nondiscrimination testing. If a plan includes the following safe harbor provisions, it automatically passes non-discrimination tests:

- A minimum safe harbor contribution to employees (typically 3% Safe Harbor Non-elective contribution to every employee or a 4% Safe Harbor Match)

- Immediate vesting of employer safe harbor contributions

In 2023, 35% of small businesses offered a safe harbor plan because they’re easy to administer and popular with employees.

Types of Safe Harbor Plans

There are three types of safe harbor 401(k) plans, each with its own features and requirements.

Traditional safe harbor

A traditional safe harbor plan requires employers to contribute between 3% and 4% of eligible employee pay to the 401(k). Those contributions must also be 100% vested immediately.

Employers have two choices on how to make contributions:

- 3% Non-elective: Contribute 3% of every eligible employee's pay to the 401(k);

- 4% Match: The traditional safe harbor match is a 100% match on the first 3% of an employee’s contribution and a 50% match on the next 2%

Enhanced safe harbor

Enhanced safe harbor contributions must also vest immediately; however, employers can structure their contribution to be more generous than the traditional safe harbor plan. For example, employers may match 100% of the first 4% of an employee’s contribution, up to 6%.

Qualified automatic contribution arrangement (QACA):

QACA plans are a great choice for employers that want a safe harbor but also want to vest contributions. QACAs require employers to automatically enroll employees in the plan but allow for a 2-year cliff vesting schedule. This is a great option for employers setting up a new 401(k) plan because it automatically complies with the SECURE 2.0 Act of 2022, which requires all plans starting in 2024 to adopt automatic enrollment. For this reason, we expect this to be one of the most popular Safe Harbor plan designs in 2024.

Another benefit of QACAs is that the employer match is 3.5% — lower than the 4% match of a traditional safe harbor plan. The typical QACA match is 100% on the first 1% of employee contributions and 50% on the next 5% (up to 3.5% total). An employer could also choose a non-elective contribution of at least 3%.

Safe Harbor 401(k) vs. Traditional 401(k): Pros and Cons

Given the requirements for a safe harbor plan, many small business owners may be wondering if adding a safe harbor is worth the effort.

There is no single right answer, it really depends on your situation, but at a high level:

Why Would a Small Business Offer a Safe Harbor 401(k) Plan?

Safe harbor 401(k) plans offer several perks for small business owners, including:

1: Tax benefits: Employer contributions are tax-deductible, which can help reduce your business's tax liability.

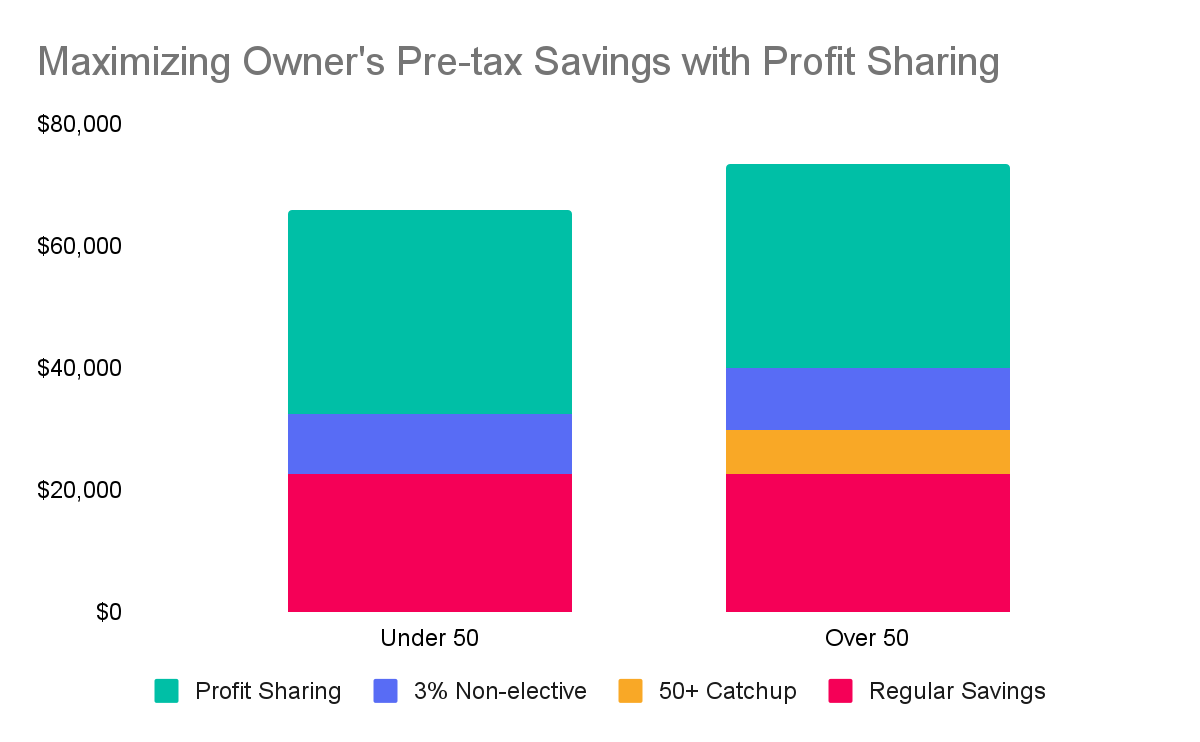

2: Personal tax shelter: In 2024, business owners had the option to combine safe harbor plans with profit-sharing plans to shelter up to $69,000 per year (under age 50) or $76,500 per year (if they are 50+).

3: Attracting and retaining employees: A strong retirement plan offering can help small businesses attract and retain top talent in a competitive job market.

4: Simplified administration: By offering a safe harbor plan, businesses can avoid the administrative hassle of nondiscrimination testing and potential corrective measures.

Avoid Nondiscrimination Tests

Traditional 401(k) plans must pass annual compliance tests (IRS annual nondiscrimination tests). If businesses fail these tests, they may need to refund money, make unexpected contributions to employees, or both.

Safe Harbor plans automatically pass these tests. However, the “free pass” can be expensive – employers need to make at least a 3% contribution to their employees’ accounts.

Nondiscrimination tests basically separate your team into two groups:

- Owners, highly paid execs (“Key Employees”) and highly compensated employees (“HCEs”)

- Everyone else (NHCEs).

To pass these tests, both groups need to join and save into the plan at roughly similar rates. But let’s look at the details.

Actual deferral percentage (ADP) and actual contribution percentage (ACP) Tests

The ADP and ACP tests compare how much highly compensated employees (HCEs) save relative to non-highly compensated employees (NHCEs). While the “Actual Deferral Percentage” (ADP) test compares the average amount employees save, the “Actual Contribution Percentage” (ACP) test compares how much each group receives in company contributions. As the limits below suggest, the ADP and ACP for HCEs and NHCEs need to be pretty close.

2024 ADP and ACP Test Limits

If a plan fails these tests, HCEs may have their contributions returned or the employer must make an additional contribution to NHCEs.

Top heavy test

The top-heavy test looks at the proportion of total plan assets owned by Key Employees. If more than 60% of plan assets are held by Key Employees, then the plan is likely top-heavy. Plans that fail the top-heavy test, may have to contribute up to 3% to every non-key employee.

New limits for key employees and HCEs

The IRS changes income limits for Key Employees and HCEs periodically, and in 2024, income limits for Officers and highly compensated non-owners increased by $5,000 to $220,000 and $155,000, respectively.

Consequences of failed compliance tests

SECURE 2.0 Act Makes it Easier to Start a Safe Harbor 401(k)

The SECURE 2.0 Act of 2022 made safe harbor plans even more attractive for small businesses by introducing new provisions, such as expanded tax credits and increased flexibility in plan design. The tax credits fall into two groups: Startup costs and contributions.

Startup cost tax credit:

The secure act may cover up to 100% of employer costs for a new 401(k) for the first three years ($250k per NHCE) for employers with fewer than 50 employees. Employers with more than 50 employees also receive the $250 per NHCE, however, their credit is limited to 50% of qualified employer costs. You can estimate your potential Secure Act tax credits here.

Employer contribution tax credit:

Employers may also be eligible for an additional $1,000 tax credit per employee for contributions to the employee's account. However, this tax credit only applies to contributions to employees that make less than $100,000 in 2023 (indexed for inflation). Additionally, this tax credit decreases each year as follows:

- Year 1: 100%

- Year 2: 100%

- Year 3: 75%

- Year 4: 50%

- Year 5: 25%

- Year 6+: 0%

To stay updated on these changes and learn how they may impact your decision to implement a Safe Harbor plan, download our 2024 Definitive Guide to Safe Harbor 401(k) Plans.

Safe Harbor Notice Requirements

Employers must provide each eligible employee an annual notice within a reasonable period before the beginning of the plan year (generally 30-90 days) or the date that employees are eligible. Both traditional Safe Harbor and QACA Safe Harbor notices must provide detailed information on the plan including:

- The matching or non-elective contribution formula

- The definition of eligible compensation

- Instructions on how to make savings elections

- Details on withdrawal and vesting provisions

Deadline to start a Safe Harbor 401(k) in 2024

Plans must send out Safe Harbor notices by Septemeber 1, 2024 to start a new Safe Harbor for 2024. New Safe Harbor plans must allow employees to save into the 401(k) for at least three months in the plan’s first year. This means that the plan must be effective as of October 1, 2024. Since employees need to have 30 days notice - the plan must send notices no later than September 1st.

Deadline to convert an existing 401(k) to a Safe Harbor

To add a Safe Harbor plan for the 2025 plan year, you will need to give employees notice no later than December 1, 2024. Consequently, we recommend consulting with your provider in October or November.

Frequently Asked Questions

Q: How much does a safe harbor 401(k) cost?

A: The overall cost of the mandatory safe harbor contribution is based on the number of eligible participants and their average salary. However, you can do a lot to contain costs by choosing the right safe harbor plan design. For example:

Two employers each have 20 employees earning an average of $80k/year.

One employer expects low plan participation (60%) while the other expects high participation (80%).

The sponsor with low participation may be better off with a 4% safe harbor match — with only 60% expected to get the full match, the employer’s total cost (as a percentage of payroll) will be 2.4%.

The second employer would likely be better off with a 3% non-elective contribution, because the match would likely be 3.2% of payroll, assuming 80% got the full match.

Moreover, companies with high employee turnover may be able to significantly reduce the cost of a safe harbor by choosing long periods for initial eligibility (up to one year).

Q: Can I change the safe harbor plan provisions mid-year?

A: If you need to make changes to your Safe Harbor 401(k) plan, you generally must do so before the beginning of the plan year in which the changes will take effect.

That said, there are a few exceptions to this rule and you may be able to make changes if:

You are only adding certain features like Roth contributions, hardship withdrawals, or in-service withdrawals

You do not increase vesting (for QACA plans only)

You do not increase eligibility requirements

You do not change the type of safe harbor (i.e., change from traditional safe harbor match to QACA)

You add (or modify) a contribution formula provided that:

- The change is adopted 3 months before the end of the year

- The change is retroactive for the entire year

- A notice is provided at least 3 months prior to the year end

- The contribution benefits employees

Q: Can I suspend safe harbor contributions?

A: It is possible to decrease or halt safe harbor contributions within a 401(k) plan during a given year, however, you must meet the requirements in the table below:

Table: Requirements for eliminating Safe Harbor contributions mid-year

Let’s walk through an example:

Acme started a safe harbor plan with a 4% non-elective 401(k) and diligently provided the required notices to employees in 2023 for the next year. The notice indicated the possibility of reducing or suspending contributions.

On May 15, 2024, the company notified employees it would suspend contributions effective June 15, 2024, and explained how employees could modify their deferrals. The company then signed the plan amendment before June 15.

The company still had to pay the 4% non-elective safe harbor contribution for the period before the safe harbor was removed (January 1, 2024 to June 15, 2024).

Because the company removed its safe harbor status, it had to perform annual tests for nondiscrimination at the end of 2024, using data from the entire year.

Q: Can I switch from a traditional 401(k) plan to a safe harbor 401(k) plan?

A: Yes, you can switch from a traditional 401(k) plan to a Safe Harbor plan by amending your plan document and meeting the required deadlines and notice requirements.

Q: Can I make additional contributions to a safe harbor 401(k) plan?

A: Yes, you can make additional profit-sharing contributions or discretionary matching contributions in addition to the required Safe Harbor contributions. These additional contributions may be subject to vesting schedules and compliance testing.

Q: Can I terminate a safe harbor 401(k) plan?

A: Yes, you can terminate a Safe Harbor plan by following the IRS guidelines for plan termination. Be aware that you must still satisfy the required contributions for the year in which the plan is terminated.

Q: When can I fund safe harbor contributions?

A: The employer contributions to Safe Harbor plans may be funded on an ongoing basis (i.e., each paycheck) or funded after the plan year. If funding on a year-end basis, the contributions must generally be funded by the date that the employer files their taxes.

Is a Safe Harbor 401(k) Right for Your Business?

A safe harbor 401(k) plan can provide significant benefits to both employers and employees, making it an attractive option for business owners looking to optimize their retirement plan offerings. By understanding the features, requirements, and advantages of safe harbor plans, you can make an informed decision and unlock the full potential of a 401(k) plan for your business.

Read the full white paper: 2024 Definitive Guide to Safe Harbor 401(k) Plans. It covers everything you need to know about Safe Harbor 401(k) plans, including how tax credits can make it completely free, including employer contributions for up to three years.